Rite Aid 2014 Annual Report Download - page 108

Download and view the complete annual report

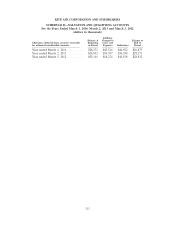

Please find page 108 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

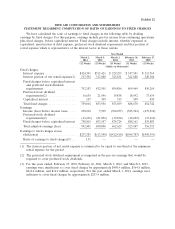

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

19. Related Party Transactions (Continued)

On September 26, 2013, the Company agreed to exchange eight shares of 7% Series G Convertible

Preferred Stock (the ‘‘Series G preferred stock’’) and 1,876,013 shares of 6% Series H Convertible

Preferred Stock (the ‘‘Series H preferred stock’’, collectively the ‘‘Preferred Stock’’) of the Company

(the ‘‘Exchange’’), held by Green Equity Investors III, L.P. (‘‘LGP’’) for 40,000,000 shares of the

Company’s common stock, par value $1.00 per share, with a market value of $190,400 at the $4.76 per

share closing price on the Settlement Date (as hereinafter defined), pursuant to an individually

negotiated exchange transaction. The Exchange settled on September 30, 2013 (the ‘‘Settlement Date’’).

The Preferred Stock, including additional shares representing earned but unpaid dividends as of the

Settlement Date, was redeemable by the Company for cash at 105% of the Preferred Stock’s $100 per

share liquidation preference or $199,937. The Company agreed to the Exchange as it was prohibited

under several of its debt instruments from using cash to effect the redemption of the Preferred Stock.

Following the Settlement Date, no shares of the Series G preferred stock or Series H preferred stock

remained outstanding and the Company’s restated certificate of incorporation was amended to

eliminate all references to the Series G preferred stock and Series H preferred stock. In accordance

with the terms of the Exchange, John M. Baumer, a member of the board of directors of the Company

and a limited partner of Leonard Green & Partners, L.P., an affiliate of the LGP, resigned from the

Company’s board of directors.

The Series G preferred stock had a liquidation preference of $100 per share and paid quarterly

dividends in additional shares at 7% of liquidation preference and could be redeemed at the

Company’s election. The Series H preferred stock paid quarterly dividends in additional shares at 6%

of liquidation preference and could be redeemed at the Company’s election. The Series G preferred

stock and Series H preferred stock were convertible into common stock of the Company, at the

holder’s option, at a conversion rate of $5.50 per share.

As of the Settlement Date, LGP held 1,904,161 shares of Series G preferred stock and Series H

preferred stock, which included 28,140 shares of earned and unpaid dividends. The Series G preferred

stock and Series H preferred stock would have converted into 34,621,117 shares of common stock at

the contracted conversion rate of $5.50 per share. Accordingly, income attributable to common

stockholders was reduced by $25,603, or $0.03 per diluted share, the value of the additional 5,378,883

shares of common stock issued upon conversion at the $4.76 per share closing price on the Settlement

Date.

The Company had a financial advisory services agreement with Leonard Green & Partners, L.P. to

pay a monthly fee of $12.5 plus out-of-pocket expenses which was terminated in fiscal 2012. The

Company paid fees of $38 for financial advisory services and expense reimbursements of $67 in fiscal

2012.

20. Subsequent Events

On April 1, 2014, the Company acquired Boston based Health Dialog Services Corporation, which

is engaged in providing health coaching, shared decision making and healthcare analytics from Bupa, a

London based international healthcare services group. Health Dialog will operate as a 100 percent

owned subsidiary of the Company.

107