Rite Aid 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cash used in financing activities was $506.1 million in fiscal 2013 and was primarily due to the

issuance of our $1,161.0 million Tranche 6 Term Loan due 2020, $470.0 million Tranche 1 Term Loan

due 2020 and $426.3 million of our 9.25% Senior Notes due 2020, along with borrowings under our

revolving credit facility of $685.0 million. Proceeds from these issuances were used to repay our

$1,036.3 million Tranche 2 Term Loan due 2014, $470.0 million of our 10.375% Senior Secured Notes

due 2016, $410.0 million of our 9.750% Senior Secured Notes due 2016, our $330.9 million Tranche 5

Term Loan due 2018, $405.0 million of our 9.375% Senior Notes due 2015, $54.2 million of our 8.625%

Senior Notes due 2015, $6.0 million of our 9.25% Senior Notes due 2013. We also made scheduled

payments of $18.5 million and $9.0 million of our capital lease obligations and our Tranche 2 and

Tranche 5 Term Loans, respectively. Additionally, we incurred financing fees for early debt retirement

of $75.4 million and cash paid for deferred financing costs of $54.8 million in connection with the

above transactions.

Cash provided by financing activities was $25.8 million in fiscal 2012 and was primarily due to

increased revolver borrowings coupled with the February 2012 issuance of $481.0 million of our 9.25%

senior notes due March 15, 2020 and concurrent repurchase of $404.8 million of our 8.625% senior

notes due March 2015. The remaining $54.2 million of the 8.625% senior notes due March 2015 were

repurchased in March 2012.

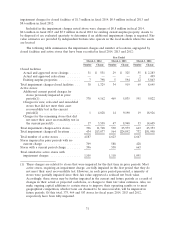

Capital Expenditures

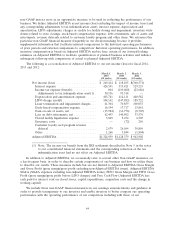

During the fiscal years ended March 1, 2014, March 2, 2013, and March 3, 2012 capital

expenditures were as follows:

Year Ended

March 1, March 2, March 3,

2014 2013 2012

(52 weeks) (52 weeks) (53 weeks)

New store construction, store relocation and store

remodel projects ........................ $218,454 $200,101 $ 93,958

Technology enhancements, improvements to

distribution centers and other corporate

requirements ........................... 115,416 115,745 121,046

Purchase of prescription files from other retail

pharmacies ............................ 87,353 67,134 35,133

Total capital expenditures ................... $421,223 $382,980 $250,137

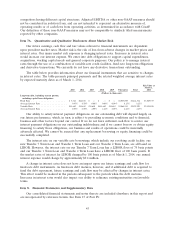

We have completed 1,215 Wellness store remodels as of March 1, 2014. We plan on making total

capital expenditures of approximately $525.0 million during fiscal 2015, consisting of approximately 53%

related to store relocations and remodels and new store construction, 30% related to infrastructure and

maintenance requirements and 17% related to prescription file purchases. Management expects that

these capital expenditures will be financed primarily with cash flow from operating activities.

Future Liquidity

We are highly leveraged. Our high level of indebtedness could: (i) limit our ability to obtain

additional financing; (ii) limit our flexibility in planning for, or reacting to, changes in our business and

the industry; (iii) place us at a competitive disadvantage relative to our competitors with less debt;

(iv) render us more vulnerable to general adverse economic and industry conditions; and (v) require us

to dedicate a substantial portion of our cash flow to service our debt. Based upon our current levels of

operations and the anticipated estimated working capital benefit of $150.0 million resulting from our

new supply agreement with McKesson, we believe that cash flow from operations together with

available borrowings under the revolving credit facility and other sources of liquidity will be adequate

40