Rite Aid 2014 Annual Report Download - page 66

Download and view the complete annual report

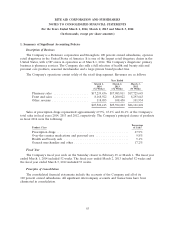

Please find page 66 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

1. Summary of Significant Accounting Policies (Continued)

Property, Plant and Equipment

Property, plant and equipment are stated at cost, net of accumulated depreciation and

amortization. The Company provides for depreciation using the straight-line method over the following

useful lives: buildings—30 to 45 years; equipment—3 to 15 years.

Leasehold improvements are amortized on a straight-line basis over the shorter of the estimated

useful life of the asset or the term of the lease. When determining the amortization period of a

leasehold improvement, the Company considers whether discretionary exercise of a lease renewal

option is reasonably assured. If it is determined that the exercise of such option is reasonably assured,

the Company will amortize the leasehold improvement asset over the minimum lease term, plus the

option period. This determination depends on the remaining life of the minimum lease term and any

economic penalties that would be incurred if the lease option is not exercised.

Capitalized lease assets are recorded at the lesser of the present value of minimum lease payments

or fair market value and amortized over the estimated useful life of the related property or term of the

lease.

The Company capitalizes direct internal and external development costs associated with

internal-use software. Neither preliminary evaluation costs nor costs associated with the software after

implementation are capitalized. For fiscal years 2014, 2013 and 2012, the Company capitalized costs of

approximately $6,547, $5,844 and $6,371, respectively.

Intangible Assets

The Company has certain finite-lived intangible assets that are amortized over their useful lives.

The value of favorable and unfavorable leases on stores acquired in business combinations are

amortized over the terms of the leases on a straight-line basis. Prescription files acquired in business

combinations are amortized over an estimated useful life of ten years on an accelerated basis, which

approximates the anticipated prescription file retention and related cash flows. Purchased prescription

files acquired in other than business combinations are amortized over their estimated useful lives of

five years on a straight-line basis.

Deferred Financing Costs

Costs incurred to issue debt are deferred and amortized as a component of interest expense over

the terms of the related debt agreements. Amortization expense of deferred financing costs was

$15,259, $21,896 and $22,049 for fiscal 2014, 2013 and 2012, respectively.

Revenue Recognition

For front end sales, the Company recognizes revenue from the sale of merchandise at the time the

merchandise is sold. The Company records revenue net of an allowance for estimated future returns.

Return activity is immaterial to revenues and results of operations in all periods presented. For third

party payor pharmacy sales, revenue is recognized at the time the prescription is filled, which is or

approximates when the customer picks up the prescription and is recorded net of an allowance for

65