Rite Aid 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

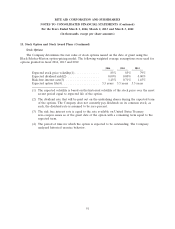

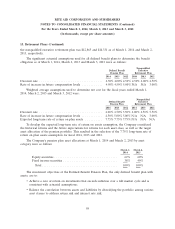

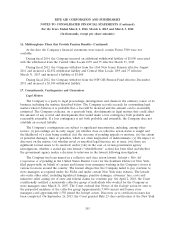

14. Reclassifications from Accumulated Other Comprehensive Loss (Continued)

The following table summarizes the effects on net income (loss) of significant amounts classified

out of each component of accumulated other comprehensive loss for the fiscal years ended March 1,

2014, March 2, 2013 and March 3, 2012:

Fiscal Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

Amount reclassified from

accumulated other

comprehensive loss

March 1, March 2, March 3,

Details about accumulated other 2014 2013 2012 Affected line item in the consolidated

comprehensive loss components (52 Weeks) (52 Weeks) (53 Weeks) statements of operations

Defined benefit pension plans

Amortization of unrecognized

prior service cost(a) ...... $ (240) $ (240) $ (639) Selling, general and

administrative expenses

Amortization of unrecognized

net loss(a) ............. (4,584) (4,792) (1,853) Selling, general and

administrative expenses

(4,824) (5,032) (2,492) Total before income tax expense

— — — Income tax expense(b)

$(4,824) $(5,032) $(2,492) Net of income tax expense

(a)—See Note 15, Retirement Plans for additional details.

(b)—Income tax expense is $0 due to the valuation allowance. See Note 5, Income Taxes for additional

details.

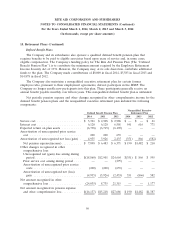

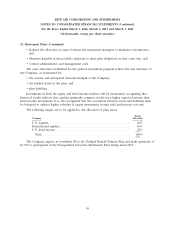

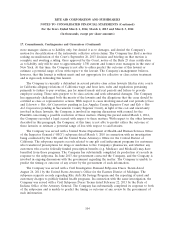

15. Retirement Plans

Defined Contribution Plans

The Company and its subsidiaries sponsor several retirement plans that are primarily 401(k)

defined contribution plans covering nonunion associates and certain union associates. The Company

does not contribute to all of the plans. In accordance with those plan provisions, the Company matches

100% of a participant’s pretax payroll contributions, up to a maximum of 3% of such participant’s

pretax annual compensation. Thereafter, the Company will match 50% of the participant’s additional

pretax payroll contributions, up to a maximum of 2% of such participant’s additional pretax annual

compensation. Total expense recognized for the above plans was $57,857 in fiscal 2014, $56,480 in fiscal

2013 and $57,036 in fiscal 2012.

The Company sponsors a Supplemental Executive Retirement Plan (‘‘SERP’’) for its officers,

which is a defined contribution plan that is subject to a five year graduated vesting schedule. The

expense recognized for the SERP was $11,531 in fiscal 2014, $7,469 in fiscal 2013 and $4,582 in fiscal

2012.

95