Rite Aid 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In fiscal 2014, 97.0% of our pharmacy sales were to customers covered by third party payors (such

as insurance companies, prescription benefit management companies, government agencies, private

employers or other managed care providers) that agree to pay for all or a portion of a customer’s

eligible prescription purchases based on negotiated and contracted reimbursement rates. During fiscal

2014, the top five third party payors accounted for approximately 65.8% of our pharmacy sales. The

largest third party payor, Express Scripts, represented 31.6% of our pharmacy sales.

During fiscal 2014, Medicaid and related managed care Medicaid payors sales were approximately

13.7% of our pharmacy sales, of which the largest single Medicaid payor was approximately 1.1% of

our pharmacy sales. During fiscal 2014, approximately 30.6% of our pharmacy sales were to customers

covered by Medicare Part D.

Competition

The retail drugstore industry is highly competitive. We compete with, among others, retail

drugstore chains, independently owned drugstores, supermarkets, mass merchandisers, discount stores,

wellness offerings, dollar stores and mail order pharmacies. We compete on the basis of store location

and convenient access, customer service, product selection and price. We believe continued

consolidation of the drugstore industry, the aggressive discounting of generic drugs by supermarkets

and mass merchandisers and the increase of promotional incentives to drive prescription sales will

further increase competitive pressures in the industry.

Marketing and Advertising

In fiscal 2014, marketing and advertising expense was approximately $322.8 million, which was

spent primarily on weekly circular advertising. Our marketing and advertising activities centered

primarily on the following:

• Product price promotions to draw customers to our stores;

• Our wellness + loyalty program, which benefits members based on accumulating points for

certain front end and prescription purchases, and offers + UP rewards to provide members

additional savings;

• Emphasis on the value of our private brand products;

• Support of specific initiatives and stores, including competitor market intrusion and prescription

file buys; and

• Our vision to be the customer’s first choice for health and wellness products, services and

information.

Under the umbrella of our ‘‘With Us It’s Personal’’ brand positioning, we promote educational

programs focusing on specific health conditions and incentives for patients to transfer their

prescriptions to Rite Aid. We are also emphasizing our automated courtesy refill service. We believe all

of these programs will help us improve customer satisfaction and grow profitable sales.

Associates

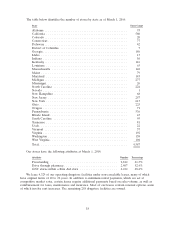

We believe that our relationships with our associates are good. As of March 1, 2014, we had

approximately 89,000 associates: 11% were pharmacists, 44% were part-time and 27% were represented

by unions. Associate satisfaction is critical to our success. Annually we survey our associates to obtain

feedback on various employment-related topics, including job satisfaction and their understanding of

our core values and mission.

9