Rite Aid 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

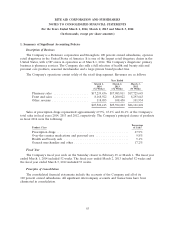

1. Summary of Significant Accounting Policies (Continued)

recorded as a reduction in selling, general and administrative expenses when the advertising

commitment has been satisfied.

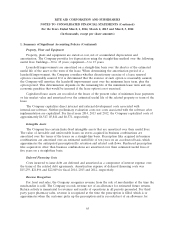

Rent

The Company records rent expense on operating leases on a straight-line basis over the minimum

lease term. The Company begins to record rent expense at the time that the Company has the right to

use the property. From time to time, the Company receives incentive payments from landlords that

subsidize lease improvement construction. These leasehold incentives are deferred and recognized on a

straight-line basis over the minimum lease term.

Selling, General and Administrative Expenses

Selling, general and administrative expenses include store and corporate administrative payroll and

benefit costs, occupancy costs which include retail store and corporate rent costs, facility and leasehold

improvement depreciation and utility costs, advertising, repair and maintenance, insurance, equipment

depreciation and professional fees.

Repairs and Maintenance

Routine repairs and maintenance are charged to operations as incurred. Improvements and major

repairs, which extend the useful life of an asset, are capitalized and depreciated.

Advertising

Advertising costs, net of specific vendor advertising allowances, are expensed in the period the

advertisement first takes place. Advertising expenses, net of vendor advertising allowances, for fiscal

2014, 2013 and 2012 were $322,843, $335,779 and $369,405, respectively.

Insurance

The Company is self-insured for certain general liability and workers’ compensation claims. For

claims that are self-insured, stop-loss insurance coverage is maintained for workers’ compensation

occurrences exceeding $1,000 and general liability occurrences exceeding $2,000. The Company utilizes

actuarial studies as the basis for developing reported claims and estimating claims incurred but not

reported relating to the Company’s self-insurance. Workers’ compensation claims are discounted to

present value using a risk-free interest rate.

Benefit Plan Accruals

The Company has several defined benefit plans, under which participants earn a retirement benefit

based upon a formula set forth in the plan. The Company records expense related to these plans using

actuarially determined amounts that are calculated under the provisions of ASC 715, ‘‘Compensation—

Retirement Benefits.’’ Key assumptions used in the actuarial valuations include the discount rate, the

expected rate of return on plan assets and the rate of increase in future compensation levels.

67