Rite Aid 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

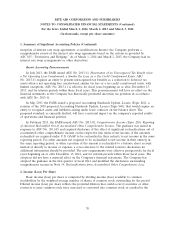

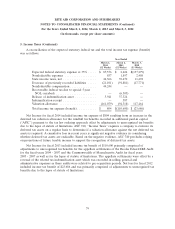

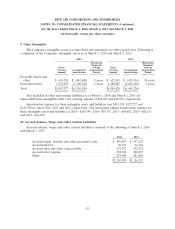

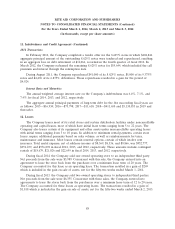

5. Income Taxes (Continued)

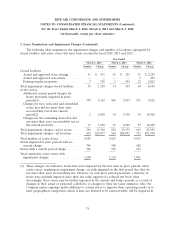

The tax effect of temporary differences that gave rise to significant components of deferred tax

assets and liabilities consisted of the following at March 1, 2014 and March 2, 2013:

2014 2013

Deferred tax assets:

Accounts receivable .......................... $ 62,973 $ 62,745

Accrued expenses ............................ 204,346 214,110

Liability for lease exit costs ..................... 116,803 142,456

Pension, retirement and other benefits ............. 174,917 219,515

Long-lived assets ............................ 424,290 374,101

Other .................................... 1,989 2,079

Credits ................................... 60,951 62,121

Net operating losses .......................... 1,428,751 1,558,694

Total gross deferred tax assets ................. 2,475,020 2,635,821

Valuation allowance .......................... (2,060,811) (2,223,675)

Total deferred tax assets ..................... 414,209 412,146

Deferred tax liabilities:

Inventory .................................. 414,209 412,146

Total gross deferred tax liabilities ............... 414,209 412,146

Net deferred tax assets ......................... $ — $ —

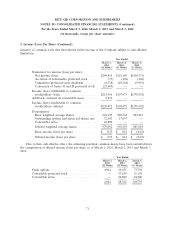

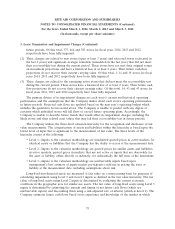

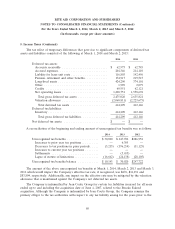

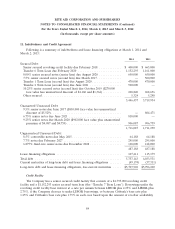

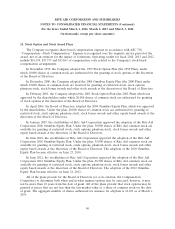

A reconciliation of the beginning and ending amount of unrecognized tax benefits was as follows:

2014 2013 2012

Unrecognized tax benefits .................. $30,020 $ 247,722 $286,952

Increases to prior year tax positions .......... — 6,305 —

Decreases to tax positions in prior periods ..... (3,215) (196,214) (11,125)

Increases to current year tax positions ........ — — —

Settlements ........................... — (3,655) —

Lapse of statute of limitations .............. (16,662) (24,138) (28,105)

Unrecognized tax benefits balance ............ $10,143 $ 30,020 $247,722

The amount of the above unrecognized tax benefits at March 1, 2014, March 2, 2013 and March 3,

2012 which would impact the Company’s effective tax rate, if recognized, was $876, $14,651 and

$83,804, respectively. Additionally, any impact on the effective rate may be mitigated by the valuation

allowance that is maintained against the Company’s net deferred tax assets.

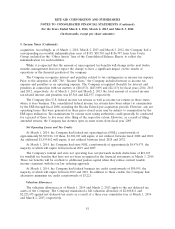

The Company is indemnified by Jean Coutu Group for certain tax liabilities incurred for all years

ended up to and including the acquisition date of June 4, 2007, related to the Brooks Eckerd

acquisition. Although the Company is indemnified by Jean Coutu Group, the Company remains the

primary obligor to the tax authorities with respect to any tax liability arising for the years prior to the

80