Rite Aid 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

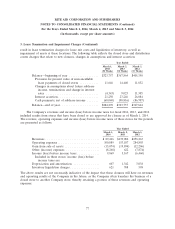

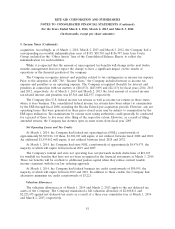

4. Fair Value Measurements

The Company utilizes the three-level valuation hierarchy as described in Note 3, Lease Termination

and Impairment Charges, for the recognition and disclosure of fair value measurements.

As of March 1, 2014 and March 2, 2013, the Company did not have any financial assets measured

on a recurring basis. Please see Note 3 for fair value measurements of non-financial assets measured on

a non-recurring basis.

Other Financial Instruments

Financial instruments other than long-term indebtedness include cash and cash equivalents,

accounts receivable and accounts payable. These instruments are recorded at book value, which we

believe approximate their fair values due to their short term nature.

The fair value for LIBOR-based borrowings under the Company’s senior secured credit facility and

first and second lien term loans are estimated based on the quoted market price of the financial

instrument which is considered Level 1 of the fair value hierarchy. The fair values of substantially all of

the Company’s other long-term indebtedness are estimated based on quoted market prices of the

financial instruments which are considered Level 1 of the fair value hierarchy. The carrying amount and

estimated fair value of the Company’s total long-term indebtedness was $5,649,732 and $6,094,285,

respectively, as of March 1, 2014. The carrying amount and estimated fair value of the Company’s total

long-term indebtedness was $5,918,352 and $6,188,597, respectively, as of March 2, 2013. There were no

outstanding derivative financial instruments as of March 1, 2014 and March 2, 2013.

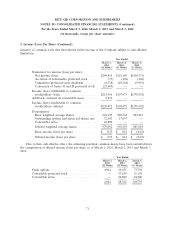

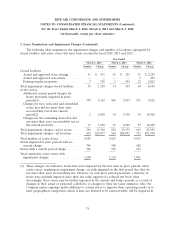

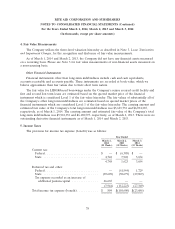

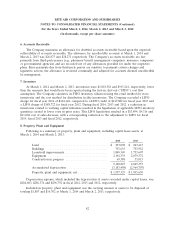

5. Income Taxes

The provision for income tax expense (benefit) was as follows:

Year Ended

March 1, March 2, March 3,

2014 2013 2012

(52 Weeks) (52 Weeks) (53 Weeks)

Current tax:

Federal .............................. $ — $ (6,305) $ —

State ............................... 4,748 7,928 3,654

4,748 1,623 3,654

Deferred tax and other:

Federal .............................. — (61,544) 1,729

State ............................... (30,609) (50,679) (29,069)

Tax expense recorded as an increase of

additional paid-in-capital ............... 26,665 — —

(3,944) (112,223) (27,340)

Total income tax expense (benefit) ............ $ 804 $(110,600) $(23,686)

78