Rite Aid 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

12. Leases (Continued)

During fiscal 2012, the Company sold two owned operating stores to independent third parties.

Net proceeds from the sale were $6,038. Concurrent with these sales, the Company entered into

agreements to lease the stores back from the purchasers over a minimum lease term of 7 to 10 years.

The Company accounted for these leases as operating leases. The transactions resulted in a loss of

$3,896 which is included in the gain on sale of assets, net for the fifty-three weeks ended March 3,

2012.

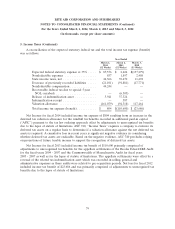

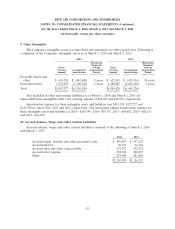

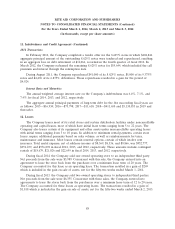

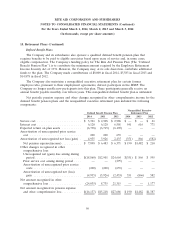

The net book values of assets under capital leases and sale-leasebacks accounted for under the

financing method at March 1, 2014 and March 2, 2013 are summarized as follows:

2014 2013

Land......................................... $ 5,063 $ 6,692

Buildings ...................................... 135,581 137,206

Leasehold improvements ........................... 1,446 1,691

Equipment ..................................... 34,305 21,316

Accumulated depreciation .......................... (113,536) (103,381)

$ 62,859 $ 63,524

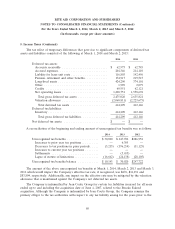

Following is a summary of lease finance obligations at March 1, 2014 and March 2, 2013:

2014 2013

Obligations under financing leases ..................... $102,671 $107,308

Sale-leaseback obligations ........................... 4,740 7,876

Less current obligation ............................. (32,240) (23,334)

Long-term lease finance obligations .................... $ 75,171 $ 91,850

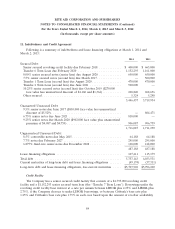

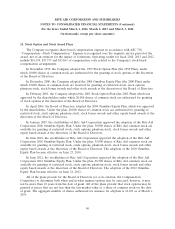

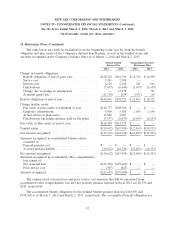

Following are the minimum lease payments for all properties under a lease agreement that will

have to be made in each of the years indicated based on non-cancelable leases in effect as of March 1,

2014:

Lease Financing Operating

Fiscal year Obligations Leases

2015 ...................................... $ 40,030 $ 996,495

2016 ...................................... 21,228 953,607

2017 ...................................... 19,330 892,261

2018 ...................................... 13,496 810,267

2019 ...................................... 12,370 713,914

Later years ................................. 33,656 3,405,091

Total minimum lease payments ................... 140,110 $7,771,635

Amount representing interest .................... (32,699)

Present value of minimum lease payments ........... $107,411

89