Rite Aid 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

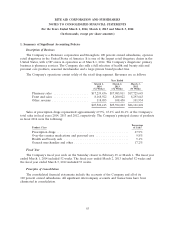

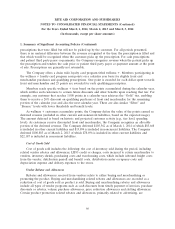

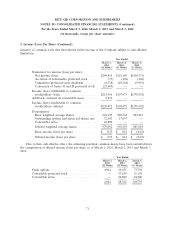

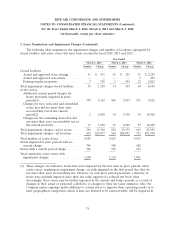

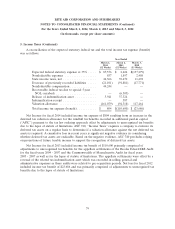

2. Income (Loss) Per Share (Continued)

issuance of common stock that then shared in the income of the Company subject to anti-dilution

limitations.

Year Ended

March 1, March 2, March 3,

2014 2013 2012

(52 Weeks) (52 Weeks) (53 Weeks)

Numerator for income (loss) per share:

Net income (loss) ...................... $249,414 $118,105 $(368,571)

Accretion of redeemable preferred stock ..... (77) (102) (102)

Cumulative preferred stock dividends ........ (8,318) (10,528) (9,919)

Conversion of Series G and H preferred stock . (25,603) — —

Income (loss) attributable to common

stockholders—basic ..................... $215,416 $107,475 $(378,592)

Add back—interest on convertible notes ....... 5,456 — —

Income (loss) attributable to common

stockholders—diluted ................... $220,872 $107,475 $(378,592)

Denominator:

Basic weighted average shares ............. 922,199 889,562 885,819

Outstanding options and restricted shares, net . 32,093 17,697 —

Convertible notes ...................... 24,800 — —

Diluted weighted average shares ........... 979,092 907,259 885,819

Basic income (loss) per share .............. $ 0.23 $ 0.12 $ (0.43)

Diluted income (loss) per share ............ $ 0.23 $ 0.12 $ (0.43)

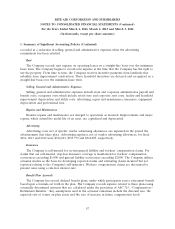

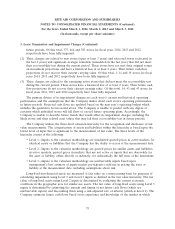

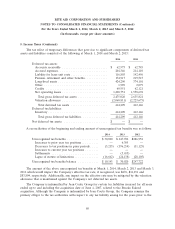

Due to their anti-dilutive effect, the following potential common shares have been excluded from

the computation of diluted income (loss) per share as of March 1, 2014, March 2, 2013 and March 3,

2012:

Year Ended

March 1, March 2, March 3,

2014 2013 2012

(52 Weeks) (52 Weeks) (53 Weeks)

Stock options ........................... 4,044 10,455 73,798

Convertible preferred stock ................. — 33,109 31,195

Convertible notes ........................ — 24,800 24,800

4,044 68,364 129,793

71