Rite Aid 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

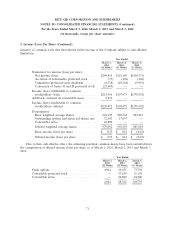

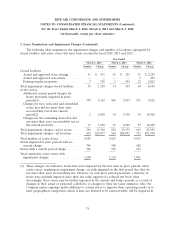

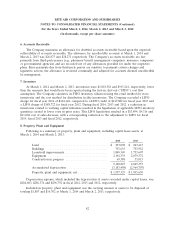

5. Income Taxes (Continued)

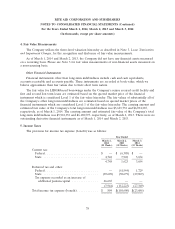

A reconciliation of the expected statutory federal tax and the total income tax expense (benefit)

was as follows:

Year Ended

March 1, March 2, March 3,

2014 2013 2012

(52 Weeks) (52 Weeks) (53 Weeks)

Expected federal statutory expense at 35% ..... $ 87,576 $ 2,626 $(137,279)

Nondeductible expenses .................. 857 1,897 2,408

State income taxes, net ................... 44,366 39,470 11,492

Decrease of previously recorded liabilities ..... (21,101) (91,881) (17,771)

Nondeductible compensation ............... 44,244 — —

Recoverable federal tax due to special 5-year

NOL carryback ....................... — (6,305) —

Release of indemnification asset ............ 5,941 37,324 —

Indemnification receipt ................... — 587 —

Valuation allowance ..................... (161,079) (94,318) 117,464

Total income tax expense (benefit) ........... $ 804 $(110,600) $ (23,686)

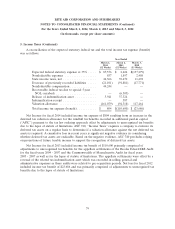

Net Income for fiscal 2014 included income tax expense of $804 resulting from an increase in the

deferred tax valuation allowance for the windfall tax benefits recorded in additional paid-in capital

(‘‘APIC’’) pursuant to the tax law ordering approach offset by adjustments to unrecognized tax benefits

due to the lapse of statute of limitations. ASC 740, ‘‘Income Taxes’’ requires a company to evaluate its

deferred tax assets on a regular basis to determine if a valuation allowance against the net deferred tax

assets is required. A cumulative loss in recent years is significant negative evidence in considering

whether deferred tax assets are realizable. Based on the negative evidence, ASC 740 precludes relying

on projections of future taxable income to support the recognition of deferred tax assets.

Net Income for fiscal 2013 included income tax benefit of $110,600 primarily comprised of

adjustments to unrecognized tax benefits for the appellate settlements of the Brooks Eckerd IRS Audit

for the fiscal years 2004 - 2007 and the Commonwealth of Massachusetts Audit for fiscal years

2005 - 2007 as well as for the lapse of statute of limitations. The appellate settlements were offset by a

reversal of the related tax indemnification asset which was recorded in selling, general and

administrative expenses as these audits were related to pre-acquisition periods. Net loss for fiscal 2012

included income tax benefit of $23,686 and was primarily comprised of adjustments to unrecognized tax

benefits due to the lapse of statute of limitations.

79