Rite Aid 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

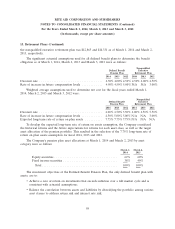

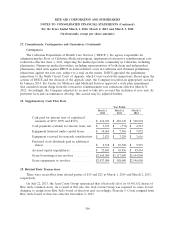

15. Retirement Plans (Continued)

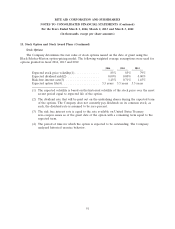

Following are the future benefit payments expected to be paid for the Defined Benefit Pension

Plan and the nonqualified executive retirement plan during the years indicated:

Nonqualified

Defined Benefit Executive

Fiscal Year Pension Plan Retirement Plan

2015 ..................................... $ 7,378 $ 1,722

2016 ..................................... 7,520 1,625

2017 ..................................... 7,687 1,599

2018 ..................................... 7,829 1,228

2019 ..................................... 8,068 1,204

2020 - 2024 ............................... 42,793 4,424

Total ................................... $81,275 $11,802

Other Plans

The Company participates in various multi-employer union pension plans that are not sponsored

by the Company. Total expenses recognized for the multi-employer plans were $26,617 in fiscal 2014,

$19,787 in fiscal 2013 and $14,594 in fiscal 2012.

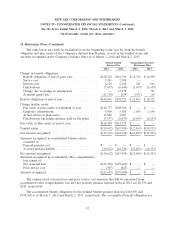

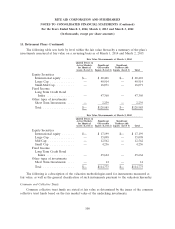

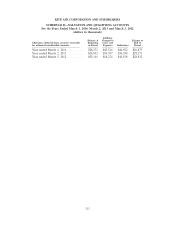

16. Multiemployer Plans that Provide Pension Benefits

The Company contributes to a number of multiemployer defined benefit pension plans under the

terms of collective-bargaining agreements that cover certain of its union-represented employees. The

risks of participating in these multiemployer plans are different from single-employer plans. Assets

contributed to the multiemployer plan by one employer may be used to provide benefits to employees

of other participating employers. If a participating employer stops contributing to the plan, the

unfunded obligations of the plan may be borne by the remaining participating employers. Additionally,

if the Company chooses to stop participating in some of its multiemployer plans, the Company may be

required to pay those plans an amount based on the underfunded status of the plan, referred to as a

withdrawal liability.

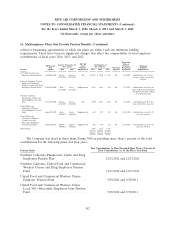

The Company’s participation in these plans for the annual period ended March 1, 2014 is outlined

in the table below. The ‘‘EIN/Pension Plan Number’’ column provides the Employer Identification

Number (EIN) and the three-digit plan number, if applicable. The most recent Pension Protection Act

(PPA) zone status available for fiscal 2014 and fiscal 2013 is for the plan year-ends as indicated below.

The zone status is based on information that the Company received from the plan and is certified by

the plan’s actuary. Among other factors, plans in the red zone are generally less than 65 percent

funded, plans in the yellow zone are less than 80 percent funded, and plans in the green zone are at

least 80 percent funded. The ‘‘FIP/RP Status Pending/Implemented’’ column indicates plans for which a

financial improvement plan (FIP) or a rehabilitation plan (RP) is either pending or has been

implemented. In addition to regular plan contributions, the Company may be subject to a surcharge if

the plan is in the red zone. The ‘‘Surcharge Imposed’’ column indicates whether a surcharge has been

imposed on contributions to the plan. The last two columns list the expiration date(s) of the

101