Rite Aid 2014 Annual Report Download - page 104

Download and view the complete annual report

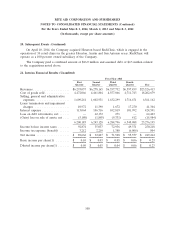

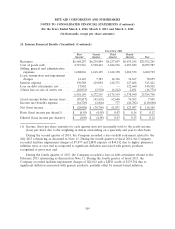

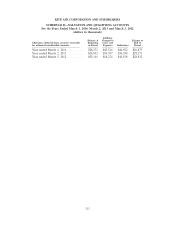

Please find page 104 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

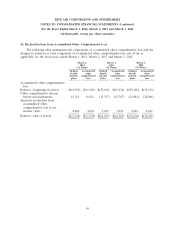

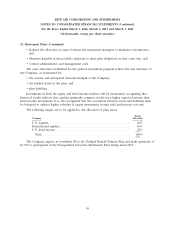

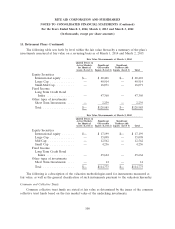

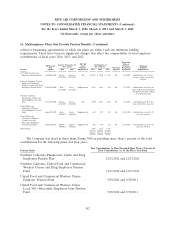

16. Multiemployer Plans that Provide Pension Benefits (Continued)

At the date the Company’s financial statements were issued, certain Forms 5500 were not

available.

During fiscal 2014, the Company incurred an additional withdrawal liability of $1,000 associated

with the withdrawal from the Central Ohio Locals 1059 and 75 effective March 31, 2013.

During fiscal 2013, the Company withdrew from the 1360 New Jersey Pension effective August

2011 and incurred a $2,032 withdrawal liability and Central Ohio Locals 1059 and 75 effective

March 31, 2013 and incurred a liability of $3,000.

During fiscal 2012, the Company withdrew from the NW OH Pension Fund effective December

2011 and incurred a $1,300 withdrawal liability.

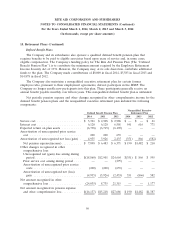

17. Commitments, Contingencies and Guarantees

Legal Matters

The Company is a party to legal proceedings, investigations and claims in the ordinary course of its

business, including the matters described below. The Company records accruals for outstanding legal

matters when it believes it is probable that a loss will be incurred and the amount can be reasonably

estimated. The Company evaluates, on a quarterly basis, developments in legal matters that could affect

the amount of any accrual and developments that would make a loss contingency both probable and

reasonably estimable. If a loss contingency is not both probable and estimable, the Company does not

establish an accrued liability.

The Company’s contingencies are subject to significant uncertainties, including, among other

factors: (i) proceedings are in early stages; (ii) whether class or collective action status is sought and

the likelihood of a class being certified; (iii) the outcome of pending appeals or motions; (iv) the extent

of potential damages, fines or penalties, which are often unspecified or indeterminate; (v) the impact of

discovery on the matter; (vi) whether novel or unsettled legal theories are at issue; (vii) there are

significant factual issues to be resolved; and/or (viii) in the case of certain government agency

investigations, whether a sealed qui tam lawsuit (‘‘whistleblower’’ action) has been filed and whether

the government agency makes a decision to intervene in the lawsuit following investigation.

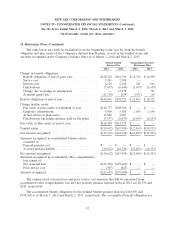

The Company has been named in a collective and class action lawsuit, Indergit v. Rite Aid

Corporation et al pending in the United States District Court for the Southern District of New York,

filed purportedly on behalf of current and former store managers working in the Company’s stores at

various locations around the country. The lawsuit alleges that the Company failed to pay overtime to

store managers as required under the FLSA and under certain New York state statutes. The lawsuit

also seeks other relief, including liquidated damages, punitive damages, attorneys’ fees, costs and

injunctive relief arising out of state and federal claims for overtime pay. On April 2, 2010, the Court

conditionally certified a nationwide collective group of individuals who worked for the Company as

store managers since March 31, 2007. The Court ordered that Notice of the Indergit action be sent to

the purported members of the collective group (approximately 7,000 current and former store

managers) and approximately 1,550 joined the Indergit action. Discovery as to certification issues has

been completed. On September 26, 2013, the Court granted Rule 23 class certification of the New York

103