Qantas 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 86

for the year ended 30 June 2010

Notes to the Financial Statements continued

Qantas Group

2010

$M

2009

$M

2008

$M

2007

$M

2006

$M

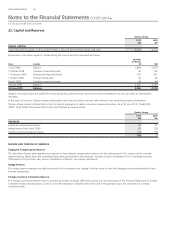

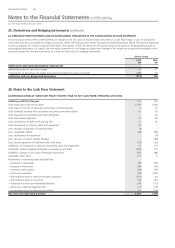

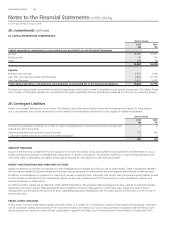

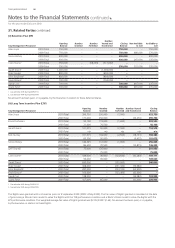

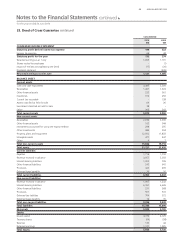

HISTORICAL AMOUNTS

Fair value of plan assets 1,964 1,944 2,142 2,353 2,411

Present value of de ned bene t obligation 2,210 2,098 1,846 1,691 2,042

(De cit)/surplus (246) (154) 296 662 369

Experience adjustments on plan assets 36 (343) (271) 27 180

Experience adjustments on plan liabilities (81) (37) (138) 112 4

Qantas Group

2010

%

2009

%

PRINCIPAL ACTUARIAL ASSUMPTIONS (EXPRESSED AS WEIGHTED AVERAGES PER ANNUM)

Discount rate 5.3 5.7

Expected return on plan assets 7.4 7.6

Future salary increases 3.0 3.0

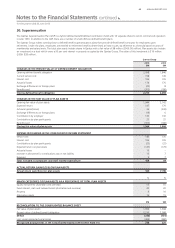

The expected long-term rate of return is based on the weighted average of expected returns on each individual asset class where the weightings

re ect the proportion of de ned bene t assets invested in each asset class. Each asset class’ expected return is based on expectations of average

returns over the next 10 years.

Employer contributions to the de ned bene t superannuation plans are based on recommendations by the plans’ actuaries. It is estimated that

$108 million will be paid by Qantas for employees accruing de ned bene ts in the year ended 30 June 2011 (2010: $121 million).

In April 2009, Qantas and the Trustee of the QSP agreed to additional funding of up to $66 million over three years following the adverse performance

of investment markets as a result of the Global Financial Crisis. As at 30 June 2010, Qantas has contributed $35 million of the additional funding.

De ned contribution fund

The Qantas Group’s results include $142 million (2009: $131 million) of expenses in relation to de ned contribution funds.

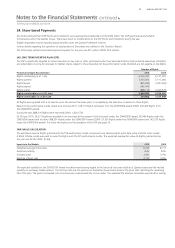

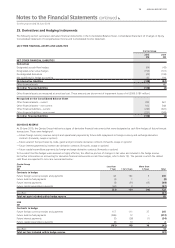

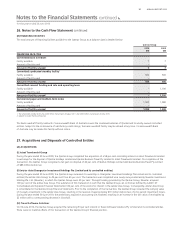

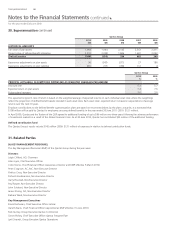

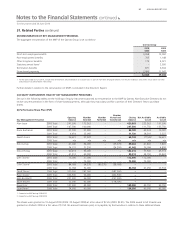

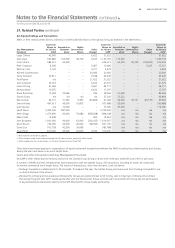

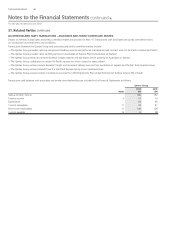

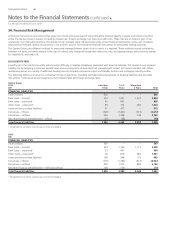

31. Related Parties

(A) KEY MANAGEMENT PERSONNEL

The Key Management Personnel (KMP) of the Qantas Group during the year were:

Directors

Leigh Clifford, AO, Chairman

Alan Joyce, Chief Executive Of cer

Colin Storrie, Chief Financial Of cer (ceased as a Director and KMP effective 5 March 2010)

Peter Cosgrove, AC, MC, Non-Executive Director

Patricia Cross, Non-Executive Director

Richard Goodmanson, Non-Executive Director

Garry Hounsell, Non-Executive Director

Paul Rayner, Non-Executive Director

John Schubert, Non-Executive Director

James Strong, AO, Non-Executive Director

Barbara Ward, Non-Executive Director

Key Management Executives

Bruce Buchanan, Chief Executive Of cer Jetstar

Gareth Evans, Chief Financial Of cer (appointed as KMP effective 15 June 2010)

Rob Gurney, Group Executive Qantas Commercial

Simon Hickey, Chief Executive Of cer Qantas Frequent Flyer

Lyell Strambi, Group Executive Qantas Operations

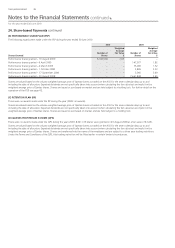

30. Superannuation continued