Qantas 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

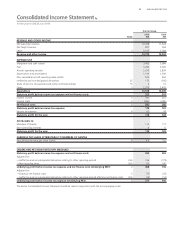

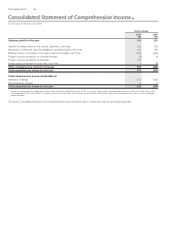

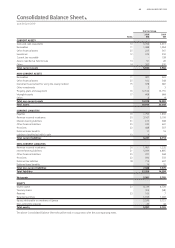

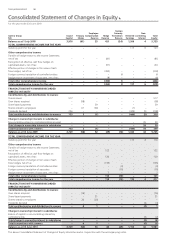

THE QANTAS GROUP 52

for the year ended 30 June 2010

Notes to the Financial Statements

Qantas Airways Limited (Qantas) is a company limited by shares,

incorporated in Australia whose shares are publicly traded on the

Australian Securities Exchange (ASX) and which is subject to the

operation of the Qantas Sale Act as described in the Corporate

Governance Statement.

The consolidated Financial Report for the year ended 30 June 2010

comprises Qantas and its controlled entities (together referred to

as the Qantas Group) and the Qantas Group’s interest in associates

and jointly controlled entities.

The Financial Report of Qantas for the year ended 30 June 2010 was

authorised for issue in accordance with a resolution of the Directors

on 30 August 2010.

(A) STATEMENT OF COMPLIANCE

The Financial Report is a general purpose nancial report which has been

prepared in accordance with Australian Accounting Standards (AASBs)

adopted by the Australian Accounting Standards Board and the

Corporations Act 2001. The Financial Report also complies with

International Financial Reporting Standards (IFRSs) and interpretations

adopted by the International Accounting Standards Board.

(B) BASIS OF PREPARATION

The Financial Report is presented in Australian dollars and has been

prepared on the basis of historical costs except in accordance with

relevant accounting policies where assets and liabilities are stated at their

fair values. Assets classi ed as held for sale are stated at the lower of

carrying amount and fair value less costs to sell.

Qantas is a company of the kind referred to in Australian Securities and

Investments Commission (ASIC) Class Order 98/100 dated 10 July 1998

(updated by CO 05/641 effective 28 July 2005 and CO 06/51 effective

31 January 2006). In accordance with that Class Order, all nancial

information presented has been rounded to the nearest million dollars,

unless otherwise stated.

The accounting policies set out below have been consistently applied

to all periods presented in the consolidated Financial Report.

The Qantas Group has adopted revised AASB 3 Business Combinations

(2008) and amended AASB 127 Consolidated and Separate Financial

Statements (2008) for business combinations occurring in the nancial

year starting 1 July 2009. All business combinations occurring on or after

1 July 2009 are accounted for by applying the acquisition method. The

change in accounting policy is applied prospectively and had no impact

in the current nancial year.

The Qantas Group has elected to apply AASB 2009-5 Further Amendments

to Australian Accounting Standards arising from the Annual Improvements

Project to the annual reporting period beginning 1 July 2009. There are

no changes resulting from the adoption of this standard except for

excluding disclosure of segment assets and liabilities.

The following standards, amendments to standards and interpretations

have been identi ed as those which may impact Qantas in the period of

initial application. They are available for early adoption at 30 June 2010,

but have not been applied in preparing this Financial Report.

—AASB 9 Financial Instruments and consequential amendments in

AASB 2009-11 Amendments to Australian Accounting Standards,

includes requirements for the classi cation and measurement of

nancial assets resulting from the rst part of Phase 1 of the project

to replace AASB 139 Financial Instruments: Recognition and

Measurement. Retrospective application is generally required,

although there are exceptions, particularly if the entity adopts the

standard for the year ended 30 June 2012 or earlier. The Qantas

Group has not yet determined the effect of the amendments to

AASB 9, which will become mandatory for the Qantas Group’s

30 June 2014 Financial Statements

—AASB 124 Related Party Disclosures (revised December 2009) and

amendments in AASB 2009-12 Amendments to Australian Accounting

Standards, simpli es and clari es the de nition of a related party. The

Qantas Group has not yet determined the effect of the amendments,

which will become mandatory for the Qantas Group’s 30 June 2012

nancial statements with retrospective application required

—AASB 2009-14 Amendments to Australian Interpretation –

Prepayments of a Minimum Funding Requirement – AASB 14, make

amendments to Interpretation 14 AASB 119 – The Limit on a De ned

Bene t Asset, Minimum Funding Requirements removing an

unintended consequence arising from the treatment of the

prepayments of future contributions in some circumstances when

there is a minimum funding requirement. The amendments, which

will become mandatory for the Qantas Group’s 30 June 2012 nancial

statements with retrospective application required, are not expected

to have any impact on the Financial Statements

(C) CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The preparation of a Financial Report in conformity with AASBs requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and reported amounts of

assets, liabilities, income and expenses. The estimates and associated

assumptions are based on historical experience and various other factors

that are believed to be reasonable under the circumstances, the results

of which form the basis for making the judgements about carrying

values of assets and liabilities that are not readily apparent from other

sources. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis.

Revisions to accounting estimates are recognised in the period in which

the estimate is revised and in any future periods affected. Judgements

made by management in the application of AASBs that have a signi cant

effect on the Financial Report and estimates with a signi cant risk of

material adjustment in future periods are highlighted below.

Change in Accounting Estimates – Passenger Aircraft Residual Value

Effective 1 January 2010, the estimated residual values of passenger

aircraft were revised to between nil and 10 per cent of acquisition cost.

The estimated residual values had been between nil and 20 per cent.

These changes resulted in an increase in depreciation expense of the

Qantas Group for the period from 1 January 2010 to 30 June 2010 of

$50 million. The annual impact of these changes will progressively

decrease until the end of the estimated useful lives of the affected assets.

Change in Accounting Estimates – Software

The Qantas Group revised the estimated useful lives of core system

software from ve to 10 years effective 1 January 2009. The net effect

of the change in the current nancial year was a decrease in amortisation

expense of the Qantas Group by $26 million (2009: $17 million).

Change in Accounting Estimates – Qantas Frequent Flyer

Qantas Frequent Flyer changed the accounting estimates of the fair value

of points and breakage expectation effective 1 January 2009. The launch

of the Qantas Frequent Flyer enhanced program in July 2008 has

improved the reliability of Management’s estimate of the fair value of

the award for which points are expected to be redeemed. The effect of

this change is being applied prospectively from 1 January 2009 for new

points issued. Unredeemed points as at 1 January 2009 remain deferred

at the previous estimate and will be redeemed at this value until these

points are extinguished.

If the accounting estimates had not been changed, the reported

revenue of the Qantas Group would be lower by $153 million (2009:

$164 million of which $84 million relates to a non-recurring bene t

arising from the direct earn conversion implemented in 2009).

1. Statement of Signi cant Accounting Policies