Qantas 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 36

for the year ended 30 June 2010

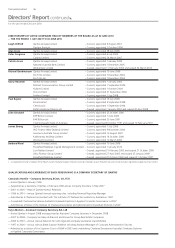

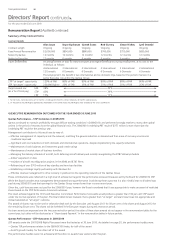

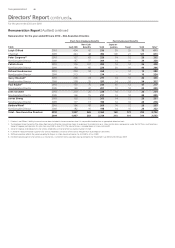

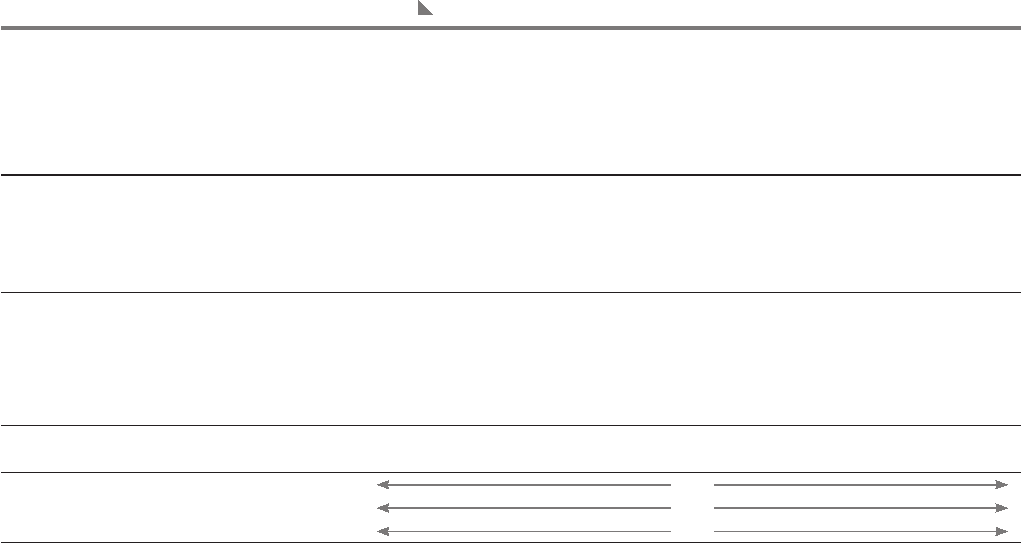

Summary of Key Contract Terms

Contract Details

Alan Joyce Bruce Buchanan Gareth Evans Rob Gurney Simon Hickey Lyell Strambi

Contract Length Ongoing Ongoing Ongoing Ongoing Ongoing Ongoing

Fixed Annual Remuneration $2,000,000 $800,000 $880,000 $700,000 $750,000 $850,000

Notice by Qantas 12 months 12 months 12 months112 months 12 months 12 months

Notice by Executive 12 months 6 months 6 months 6 months 6 months 6 months

Travel Entitlements An annual bene t of trips for these Executives and eligible bene ciaries during employment, at no cost to the

individual, as follows:

4 International 2 International 2 International 2 International 2 International 2 International

12 Domestic 6 Domestic 6 Domestic 6 Domestic 6 Domestic 6 Domestic

Post employment, the bene t is two international and six domestic trips, based on the period of service in a

senior Executive role within the Qantas Group.

STIP “at target” opportunity 120% of FAR 80% of FAR 80% of FAR 80% of FAR 80% of FAR 80% of FAR

LTIP “at target” opportunity 250,000 Rights225% of FAR 25% of FAR 25% of FAR 25% of FAR 25% of FAR

Target reward mix

(as a % of total pay)

FAR 38% 49%

STIP 45% 39%

LTIP 17% 12%

1. For Mr Evans, notice by Qantas of 12 months is made up of 6 month’s written notice plus 6 month’s severance pay.

2. Of the pool of 750,000 Rights approved by shareholders at the 2008 AGM, 250,000 Rights were awarded to the CEO in 2009/2010.

Remuneration Report (Audited) continued

Directors’ Report continued

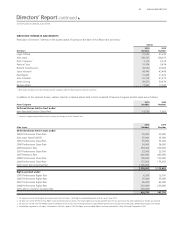

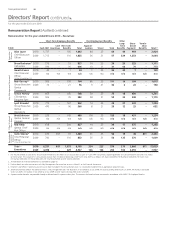

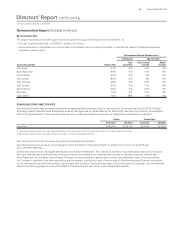

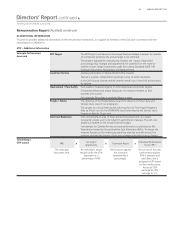

4) EXECUTIVE REMUNERATION OUTCOMES FOR THE YEAR ENDED 30 JUNE 2010

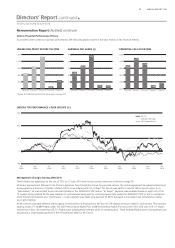

Qantas Performance – STIP Outcomes in 2009/2010

Qantas continued to maintain pro tability through dif cult trading conditions in 2009/2010, and performed strongly relative to many other global

airlines in the period of recovery from the global nancial crisis. The 2009/2010 Underlying PBT result of $377 million is more than triple the

Underlying PBT result for the previous year.

Management contribution to this result was by way of:

—Effective management of capacity across the network, matching the general reduction in demand and then areas of recovery as economic

conditions improved

—Signi cant unit cost reductions in both domestic and international operations, despite implementing the capacity reductions

—Maintenance of cash balances and investment grade credit ratings

—Maintenance of market share of business travellers

—Managing the delivery schedule of aircraft, both deferring aircraft delivery and recently renegotiating the B787 delivery schedule

—Jetstar’s expansion in Asia

—Initiation of aircraft recon guration projects in the A380 and B747 eets

—Re nancing of over $700 million of key standby and term loan facilities

—Establishing a strategic loyalty partnership with Woolworths

—Effective revenue management to drive recovery in yields across the operating networks of the Qantas Group

These contributions were re ected in a high level of achievement against the performance scorecard measures set by the Board for 2009/2010 STIP.

While the Board considers that management demonstrated strong performance in achieving these outcomes it is also mindful that no dividend was

paid during 2009/2010 and that earnings for the Qantas Group remain lower than in some recent years.

Given this, cash bonuses were not paid for the 2009/2010 year, however the Board considered that it was appropriate to make an award of restricted

shares based on the STIP Performance Scorecard outcomes.

The result achieved against the CEO’s and Executive Committee’s Performance Scorecards would produce a greater than 100 per cent STIP award

under the normal operation of the plan. The Board determined, however, that a greater than “at target” scorecard result was not appropriate and

instead awarded an “at target” outcome.

This award of shares may not be sold or otherwise dealt with by the Executive until August 2011 for 50 per cent of the shares and August 2012 for

the remaining 50 per cent. The shares will be forfeited if the Executive resigns during this restriction period.

As share awards are expensed over the two year restriction period, the value of these share awards do not appear in the remuneration tables for the

current year, but rather will be disclosed as a “Share-based Payment” in the remuneration tables in future periods.

Qantas Performance – LTIP Outcomes in 2009/2010

LTIP awards under the 2007/2008 Rights Plan award were rst tested as at 30 June 2010. As detailed on page 35, the performance hurdles were:

—Qantas TSR performance relative to the S&P/ASX100 Index, for half of the award

—An EPS growth hurdle, for the other half of the award

The performance hurdles were not achieved and therefore no awards have vested under this plan.