Qantas 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103 ANNUAL REPORT 2010

for the year ended 30 June 2010

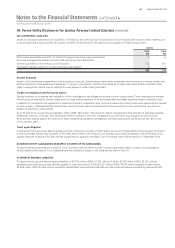

Notes to the Financial Statements continued

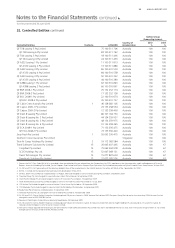

36. Parent Entity Disclosures for Qantas Airways Limited (Qantas) continued

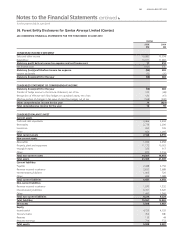

(D) CONTINGENT LIABILITIES

Details of contingent liabilities are set out below. The Directors are of the opinion that provisions are not required with respect to these matters, as it

is not probable that a future sacri ce of economic bene ts will be required or the amount is not capable of reliable measurement.

Qantas

2010

$M

2009

$M

Performance guarantees and letters of comfort to support operating lease commitments

and other arrangements entered into with other parties by controlled entities

56

General guarantees in the normal course of business 172 161

Contingent liabilities relating to current and threatened litigation 3 3

180 170

Aircraft nancing

As part of the nancing arrangements for the acquisition of aircraft, Qantas has provided certain guarantees and indemnities to various lenders and

equity participants in leveraged lease transactions. In certain circumstances, including the insolvency of major international banks and other AAA

rated counterparties, Qantas may be required to make payments under these guarantees.

Freight investigations and third party actions

Qantas continues to co-operate with regulators in their investigations into alleged price xing in the air cargo market. These investigations revealed

that the practice adopted by Qantas Freight and the cargo industry generally to x and impose fuel surcharges breached certain competition laws.

In addition to investigations by regulators for breaches of relevant competition laws, third party class actions have commenced against Qantas (as well

as other airlines) in Australia and the United States. Qantas has also been threatened with third party actions in other jurisdictions. Qantas has a

number of defences to these actions.

As at 30 June 2010, Qantas has provided $31 million (2009: $30 million). This provision re ects management’s best estimate of potential penalties,

settlements and costs in Europe, New Zealand and other jurisdictions. However, management’s current view may change as a result of future

developments. Qantas expects the outcome of these outstanding regulatory investigations and third party actions will be known over the course

of the next few years.

Travel agent litigation

A class action claim was made against Qantas and other airlines by a number of travel agents as a result of travel agents not being paid commission

on fuel surcharges. Qantas was successful in the initial action heard in the Federal Court, but was unsuccessful on appeal to the full Federal Court.

Qantas continues to dispute this claim and has sought leave to appeal to the High Court of Australia which will be heard on 3 September 2010.

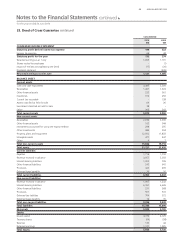

(E) PARENT ENTITY GUARANTEES IN RESPECT OF DEBTS OF ITS SUBSIDIARIES

The parent entity has entered into a Deed of Cross Guarantee with the effect that the Company guarantees debts in respect of its subsidiaries.

Further details of the Deed of Cross Guarantee and the subsidiaries subject to the Deed are disclosed in Note 33.

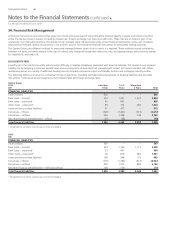

(F) INTEREST BEARING LIABILITIES

The parent entity has total interest bearing liabilities of $7,764 million (2009: $7,352 million) of which $3,543 million (2009: $2,951 million)

represents lease and hire purchase liabilities payable to controlled entities. Of the $4,221 million (2009: $4,401 million) payable to other parties,

$2,204 million (2009: $2,465 million) represents secured bank loans and lease liabilities with the remaining balance representing unsecured loans.