Qantas 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35 ANNUAL REPORT 2010

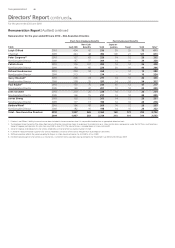

for the year ended 30 June 2010

Long Term Incentive Plan (LTIP)

What is the LTIP? The LTIP involves the granting of Rights over Qantas shares. If performance conditions are satis ed the Rights

vest and convert to Qantas shares. If performance conditions are not met, the Rights lapse.

What are the LTIP

performance conditions

and how is performance

assessed?

Since 2007/2008, the performance conditions for LTIP awards have been:

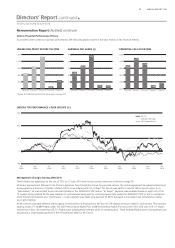

—An Earnings Per Share target (EPS)

—The relative Total Shareholder Return (TSR) of Qantas compared to the S&P/ASX100 Index

The Board has approved a change to the LTIP target for the 2011-2013 LTIP. The new performance conditions

are outlined below.

What is the vesting

scale for the EPS

performance hurdle?

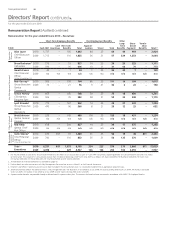

Up to one-half of the total number of LTIP Rights awarded on 9 September 2009 under the 2010-2012 LTIP may

vest subject to the follow scale:

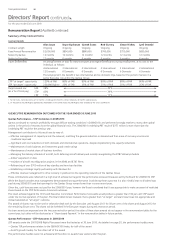

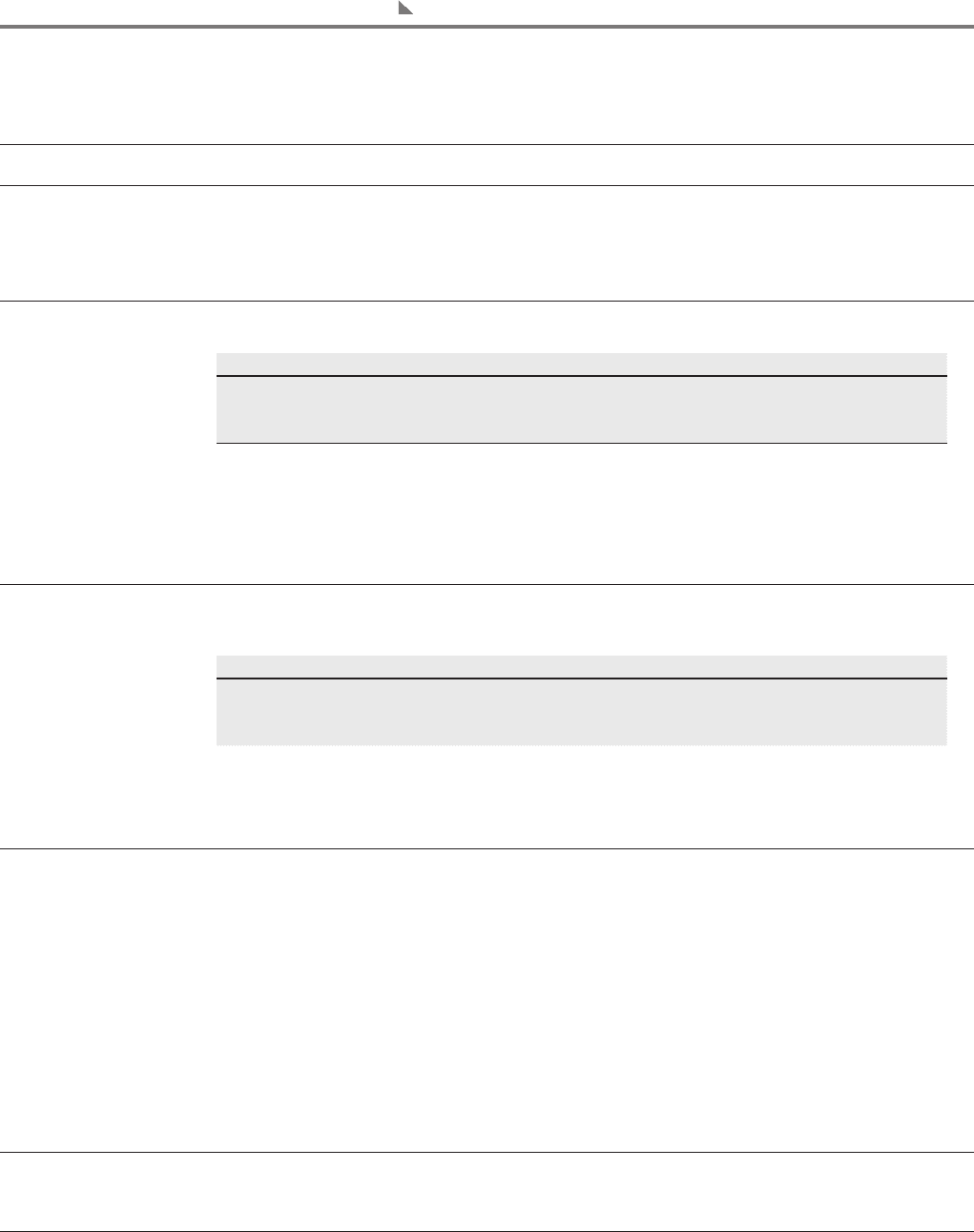

EPS Performance (for the year ended 30 June 2012) Vesting Scale

EPS result below threshold of $0.367 Nil vesting

EPS result between threshold of $0.367 and stretch target of $0.404 Linear scale: 50% to 99% vesting

EPS result at or above or above stretch target of $0.404 100% vesting

The EPS target does not represent an earnings forecast nor is it a disclosure of targets under Qantas’ long-term

budget. The target was set at a level that returns Qantas earnings to the levels achieved from 2005/2006 to

2007/2008.

For the 2007/2008 and 2008/2009 LTIP awards the EPS thresholds and stretch targets were expressed as compound

annual growth rates. The EPS threshold for the 2007/2008 award was 9.5 per cent and for the 2008/2009 award

was 6.0 per cent. The stretch targets for both years were a compound annual growth rate of 12.5 per cent.

What is the vesting

scale for the relative

TSR hurdle?

Up to one-half of the total number of LTIP Rights awarded on 9 September 2009 under the 2010-2012 LTIP may

vest subject to Qantas’ relative TSR ranking in the S&P/ASX100 Index over the three year performance period,

as follows:

Qantas TSR Rank in the S&P/ASX100 Index Vesting Scale

Below 50th percentile Nil vesting

Between 50th to 74th percentile Linear scale: 50% to 99% vesting

At or above 75th percentile 100% vesting

Since 2008, LTIP awards have been subject to a single test (with no retesting) at the conclusion of the three year

performance period. Any Rights that do not meet the performance conditions at the test will lapse.

For the 2007/2008 Rights award, relative TSR versus the S&P/ASX100 Index was tested as at 30 June 2010 and

further tests will occur each six months until 30 June 2012.

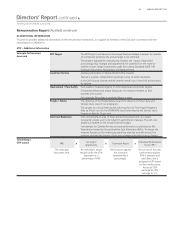

What changes have been

made to the performance

conditions for the

2011-2013 LTIP awards?

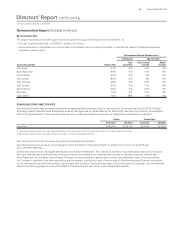

During 2009/2010, the Remuneration Committee reviewed the design of the Qantas LTIP. Based on the results of

this review, at its June 2010 Meeting, the Board approved the following changes to the hurdles for the 2011-2013

LTIP award:

—Retain the relative TSR hurdle against the S&P/ASX100 Index

—Introduce a relative TSR hurdle against a global airline peer group

—Discontinue the EPS hurdle

Measuring relative TSR index against a global airline peer group is consistent with the Group’s goal of being the

“world’s leading premium and low cost airlines”.

In a cyclical industry, the setting of EPS targets each year for multi-year periods has presented considerable practical

dif culties. As a result, the Board has decided to replace the EPS hurdle and instead measure the performance

against its Airline Peer Group.

The Airline Peer Group will comprise the following basket of global listed airlines: Air France-KLM, Air New Zealand,

AMR Corporation (American Airlines), British Airways, Cathay Paci c, Delta Northwest Airlines, Lufthansa, Ryanair,

Singapore Airlines, Southwest Airlines, Tiger Airways and Virgin Blue.

How are Rights treated

on termination?

Any Rights which have not vested will lapse if the relevant Executive ceases employment with the Qantas

Group, except in limited special “good leaver” circumstances provided under the DSP Terms and Conditions

(for example, retirement, death or total and permanent disablement). Rights will also lapse if the Executive

is guilty of gross misconduct.

Other bene ts such as superannuation and travel are detailed on page 42.

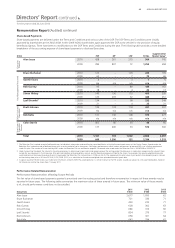

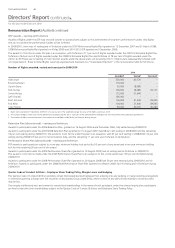

Remuneration Report (Audited) continued

Directors’ Report continued