Qantas 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 60

for the year ended 30 June 2010

Notes to the Financial Statements continued

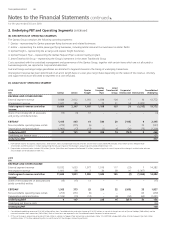

(B) DESCRIPTION OF OPERATING SEGMENTS

The Qantas Group comprises the following operating segments:

1. Qantas – representing the Qantas passenger ying businesses and related businesses

2. Jetstar – representing the Jetstar passenger ying businesses, including Jetstar Asia and the investment in Jetstar Paci c

3. Qantas Freight – representing the air cargo and express freight businesses

4. Qantas Frequent Flyer – representing the Qantas Frequent Flyer customer loyalty program

5. Jetset Travelworld Group – representing the Group’s investment in the Jetset Travelworld Group

Costs associated with the centralised management and governance of the Qantas Group, together with certain items which are not allocated to

business segments, are reported as Corporate/Unallocated.

Fuel and foreign exchange hedge gains/losses are allocated to Segments based on the timing of underlying transactions.

Intersegment revenue has been determined on an arm’s length basis or a cost plus margin basis depending on the nature of the revenue. Ancillary

and support services are allocated to segments on a cost only basis.

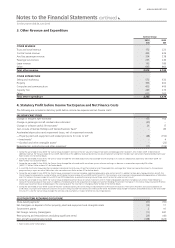

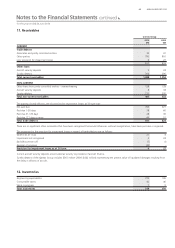

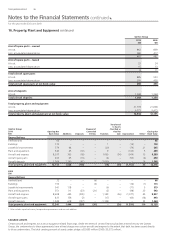

(C) ANALYSIS BY OPERATING SEGMENT

2010

$M Qantas Jetstar

Qantas

Freight

Qantas

Frequent

Flyer

Jetset

Travelworld

Group

Corporate/

Unallocated Eliminations

Consolidated

Underlying

REVENUE AND OTHER INCOME

External segment revenue 9,588 2,012 1,003 1,038 104 17 10 13,772

Intersegment revenue 1,021 185 4 70 31 14 (1,325) –

Total segment revenue and other

income

10,609 2,197 1,007 1,108 135 31 (1,315) 13,772

Share of net (loss)/pro t of associates

and jointly controlled entities

(13) (3) 12 – – – – (4)

EBITDAR11,415 463 61 330 20 (103) 9 2,195

Non-cancellable operating lease rentals (279) (315) (6) – – – 73 (527)

Depreciation and amortisation2(1,069) (17) (13) (2) (6) (20) (73) (1,200)

Underlying EBIT 67 131 42 328 14 (123) 9 468

Underlying net nance costs (91)

Underlying PBT 377

1. Pro t before income tax expense, depreciation, amortisation, non-cancellable operating lease rentals and net nance costs (EBITDAR) includes $153 million (Qantas Frequent Flyer

$152 million and Eliminations $1 million) representing the full year impact of the change in accounting estimate described in Note 1(C).

2. Depreciation and amortisation includes $50 million (Qantas $48 million and Corporate/Unallocated $2 million) representing the six month impact of the change in residual value estimate

for passenger aircraft described in Note 1(C).

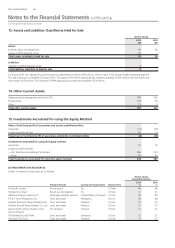

2009

$M

REVENUE AND OTHER INCOME

External segment revenue 10,532 1,653 1,077 1,019 117 (23) 7 14,382

Intersegment revenue 1,092 198 3 30 28 16 (1,367) –

Total segment revenue and other

income1

11,624 1,851 1,080 1,049 145 (7) (1,360) 14,382

Share of net (loss)/pro t of associates and

jointly controlled entities

(13) (15) 13 – – – – (15)

EBITDAR21,363 373 25 226 22 (205) 33 1,837

Non-cancellable operating lease rentals (253) (251) (6) – – – 60 (450)

Depreciation and amortisation (1,106) (15) (12) – (6) (52) (60) (1,251)

Underlying EBIT 4 107 7 226 16 (257) 33 136

Underlying net nance costs (36)

Underlying PBT 100

1. Consolidated underlying revenue of $14,382 million differs from Consolidated sales and other income of $14,552 million as a result of the gain on sale of Qantas Holidays ($86 million) and the

revenue from direct earn conversion ($84 million). Both of these items are reported in the Consolidated Income Statement as other revenue.

2. Of the net change in accounting estimates of $164 million in relation to frequent yer accounting as described in Note 1(C), EBITDAR includes $80 million (Qantas Frequent Flyer $63 million

and Eliminations $17 million) representing the six month impact of the change in accounting estimate.

2. Underlying PBT and Operating Segments continued