Qantas 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17 ANNUAL REPORT 2010

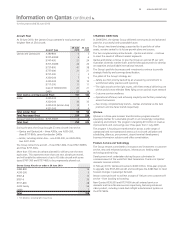

for the year ended 30 June 2010

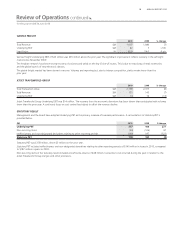

Review of Operations continued

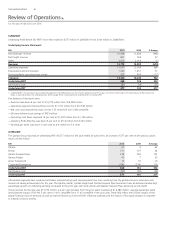

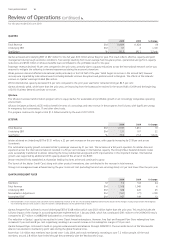

Operating expenses for the year were $11,577 million, an improvement of 8 per cent from the prior year’s operating expenses of $12,545 million.

Unit costs improved by 8 per cent to 8.07 cents/ASK from 8.80 cents/ASK in the prior year. These improvements were attributable to substantial

reductions in fuel and manpower costs, and savings of $533 million for the year from the QFuture program. Fuel into-plane prices were 13 per cent

lower than 2008/2009. Excluding fuel and one-off items, net underlying unit costs were 5.55 cents/ASK, an improvement of 4 per cent on the

previous year’s result of 5.80 cents/ASK.

2010 2009 % change

Available Seat Kilometres (ASKs)1M 124,717 124,594 0.1

Revenue Passenger Kilometres (RPKs)2M 100,727 99,176 1.6

Passenger Numbers ’000 41,428 38,438 7.8

Seat Factor % 80.8 79.6 1.2 pts

Yield (excluding FX) c/RPK 10.61 11.43 (7.2)

Net Underlying unit cost3c/ASK 5.55 5.80 4.3

1. ASK – total number of seats available for passengers, multiplied by the number of kilometres own.

2. RPK – total number of paying passengers carried, multiplied by the number of kilometres own.

3. Net Underlying unit cost – Net expenditure excluding fuel and one-off items per ASK.

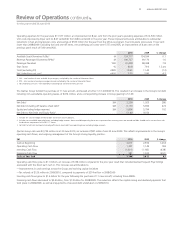

The Qantas Group funded the purchase of 11 new aircraft, and leased a further 12 in 2009/2010. This resulted in an increase in the Group’s net debt

including non-cancellable operating leases, of $474 million, and a corresponding increase in Group gearing to 51:49.

2010 2009 $ change

Net Debt1$M 2,209 1,923 286

Net Debt including off balance sheet debt2$M 6,170 5,696 474

Equity (excluding hedge reserves) $M 5,896 5,794 102

Net Debt to Net Debt and Equity Ratio351:49 50:50

1. Includes fair value of hedges related to debt and aircraft security deposits.

2. Includes non-cancellable operating leases, excluding hedge reserves. Non-cancellable operating leases are a representation assuming assets are owned and debt funded and is not consistent with

the disclosure requirements of AASB 117: Leases.

3. Net Debt to Net Debt and Equity (including off balance sheet debt from operating leases excluding hedge reserves).

Qantas Group cash was $3,704 million as at 30 June 2010, an increase of $87 million from 30 June 2009. This re ects improvements in the Group’s

operating cash ows, and ongoing management of the Group’s strong liquidity position.

$M 2010 2009 $ change

Cash at Beginning 3,617 2,599 1,018

Operating Cash Flow 1,307 1,149 158

Investing Cash Flow (1,601) (1,163) (438)

Financing Cash Flow 381 1,032 (651)

Cash at Year End 3,704 3,617 87

Operating cash ow grew to $1.3 billion, an increase of $158 million compared to the prior year result that included Qantas Frequent Flyer billings

associated with the direct earn rush in. This increase was attributable to:

—Improvements in cash earnings across the Group and working capital initiatives

—Tax refunds of $129 million in 2009/2010, compared to payments of $274 million in 2008/2009

Investing cash ows grew to $1.6 billion for the year following the purchase of 11 new aircraft, including three A380s.

Financing cash ows decreased to $0.4 billion, from $1.0 billion for 2008/2009. The reduction re ects the capital raising and dividend payments that

took place in 2008/2009, as well as prepayments of secured debt undertaken in 2009/2010.