Qantas 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81 ANNUAL REPORT 2010

for the year ended 30 June 2010

Notes to the Financial Statements continued

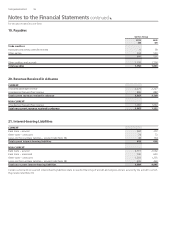

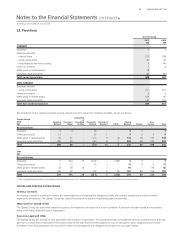

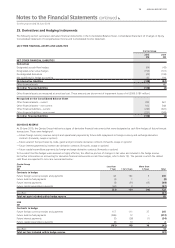

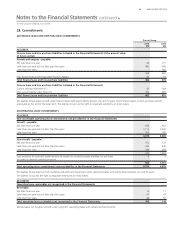

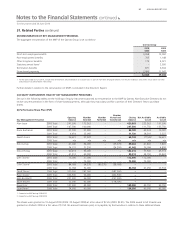

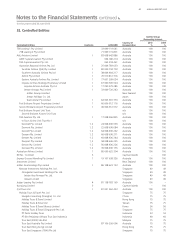

(B) FINANCING FACILITIES

The total amount of nancing facilities available to the Qantas Group as at balance date is detailed below:

Qantas Group

2010

$M

2009

$M

FINANCING FACILITIES

Committed bank overdraft

Facility available 77

Amount of facility used ––

Amount of facility unused 77

Committed syndicated standby facility1

Facility available 500 500

Amount of facility used ––

Amount of facility unused 500 500

Committed secured funding and sale and operating lease

Facility available – 1,100

Amount of facility used ––

Amount of facility unused – 1,100

Commercial paper and medium-term notes

Facility available21,000 1,000

Amount of facility used ––

Amount of facility unused 1,000 1,000

1. The syndicated standby facility has $200 million maturing on 8 August 2011 and $300 million maturing on 26 May 2013.

2. Subject to Dealer Panel participation.

The bank overdraft facility held with Commonwealth Bank of Australia covers the combined balances of Qantas and its wholly-owned controlled

entities. Subject to the continuance of satisfactory credit ratings, the bank overdraft facility may be utilised at any time. Commonwealth Bank

of Australia may terminate this facility without notice.

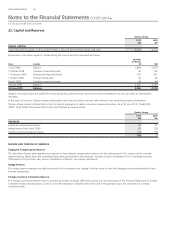

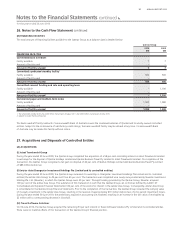

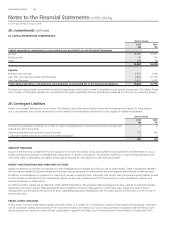

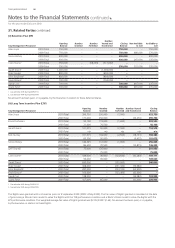

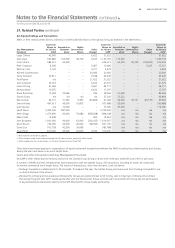

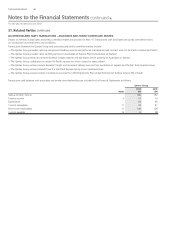

27. Acquisitions and Disposals of Controlled Entities

(A) ACQUISITIONS

(i) Jetset Travelworld Group

During the year ended 30 June 2009, the Qantas Group completed the acquisition of a 58 per cent controlling interest in Jetset Travelworld Limited

in exchange for the disposal of Qantas Holidays Limited and Qantas Business Travel Pty Limited to Jetset Travelworld Limited. On completion of the

transaction, the Qantas Group recognised a net gain on disposal of 42 per cent of Qantas Holidays Limited and Qantas Business Travel Pty Limited

of $86 million before tax.

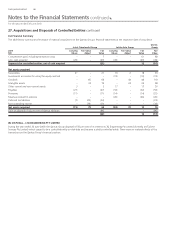

(ii) Jetstar Asia (Orangestar Investment Holdings Pte Limited and its controlled entities)

During the year ended 30 June 2009, the Qantas Group increased its ownership in Orangestar Investment Holdings Pte Limited and its controlled

entities (the Jetstar Asia Group) to 49 per cent from 45 per cent. The transaction was completed via a newly incorporated entity, Newstar Investment

Holding Pte. Ltd. (Newstar), in which the Qantas Group owns 49 per cent. Through funding provided by the Qantas Group, Newstar acquired

100 per cent of the Jetstar Asia Group. The substance of this transaction is such that the Qantas Group can control (as de ned by AASB 127

Consolidated and Separate Financial Statements) 100 per cent of the economic interest in the Jetstar Asia Group. Consequently, Jetstar Asia Group

is consolidated in the Qantas Group Financial Statements. Prior to the completion of the transaction, the Qantas Group reviewed the carrying value

of its equity investment in the Jetstar Asia Group, resulting in the reversal of approximately $19 million (before tax) of prior period impairment losses.

During the year ended 30 June 2010, the preliminary acquisition accounting was nalised, resulting in an increase in the fair value of receivables by

$2 million with a corresponding decrease in Goodwill.

(iii) Travel Software Solutions

On 30 June 2010, the Qantas Group acquired the remaining 33 per cent interest in Travel Software Solutions Pty Limited and its controlled entities.

There were no material effects of this transaction on the Qantas Group’s nancial position.

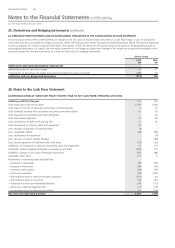

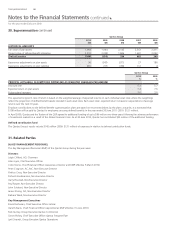

26. Notes to the Cash Flow Statement continued