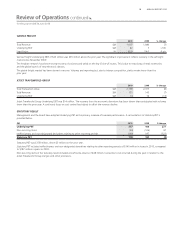

Qantas 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23 ANNUAL REPORT 2010

for the year ended 30 June 2010

The Board and Audit Committee closely monitor the independence of

the external auditor. Regular reviews occur of the independence

safeguards put in place by the external auditor. As required by section

300(11D)(a) of the Corporations Act and the Audit Committee Charter,

the Audit Committee has advised the Board that it is appropriate for the

following statement to be included in the 2010 Directors’ Report under

the heading “Non-audit Services”:

“The Directors are satis ed that:

a. The non-audit services provided during the 2009/2010 nancial year

by KPMG as the external auditor were compatible with the general

standard of independence for auditors imposed by the Corporations

Act 2001; and

b. Any non-audit services provided during the 2009/2010 nancial year

by KPMG as the external auditor did not compromise the auditor

independence requirements of the Corporations Act 2001 for the

following reasons:

– KPMG services have not involved partners or staff acting in a

managerial or decision-making capacity within the Qantas Group

or being involved in the processing or originating of transactions

– KPMG non-audit services have only been provided where Qantas

is satis ed that the related function or process will not have a

material bearing on the audit procedures

– KPMG partners and staff involved in the provision of non-audit

services have not participated in associated approval or

authorisation processes

– A description of all non-audit services undertaken by KPMG and

the related fees have been reported to the Board to ensure

complete transparency in relation to the services provided

– The declaration required by section 307C of the Corporations Act

2001 con rming independence has been received from KPMG”

Qantas rotates the lead audit partner every ve years and imposes

restrictions on the employment of ex-employees of the external auditor.

Policies are in place to restrict the type of non-audit services which can

be provided by the external auditor and there is a detailed quarterly

review of non-audit fees paid to the external auditor.

At each Meeting, the Audit Committee meets privately with Executive

Management without the external auditor and with the internal and

external auditors without Executive Management.

THE BOARD MAKES TIMELY AND BALANCED DISCLOSURE

Qantas has an established process to ensure that it is in compliance with

its ASX Listing Rule disclosure requirements. This includes a quarterly

con rmation by all Executive Management that their areas have complied

with the Continuous Disclosure Policy, together with an ongoing

obligation to advise the Company Secretary of any material non-public

information arising in between con rmations.

The Continuous Disclosure Policy is summarised in the Qantas Group

Business Practices Document which is available in the Corporate

Governance section on the Qantas website.

THE BOARD RESPECTS THE RIGHTS OF SHAREHOLDERS

Qantas has a Shareholder Communications Policy which promotes

effective communication with shareholders and encourages participation

at general meetings. The Qantas Shareholder Communications Policy is

summarised in the Qantas Group Business Practices Document which is

available in the Corporate Governance section on the Qantas website.

Qantas makes all ASX announcements available via its website. In

addition, shareholders who are registered receive email noti cation of

announcements.

The 2010 Notice of Annual General Meeting (AGM) will be provided to

all shareholders and posted on the Qantas website, and the 2010 AGM

will be available for viewing by live and archived webcast. For shareholders

unable to attend, an AGM Question Form will accompany the Notice of

Meeting, giving shareholders the opportunity to forward questions and

comments to Qantas or the external auditor prior to the AGM.

Auditor at AGM

The external auditor attends the AGM and is available to answer

shareholder questions on:

—The conduct of the audit

—The preparation and content of the auditor’s report

—The accounting policies adopted by Qantas in relation to the

preparation of the Financial Report

—The independence of the auditor in relation to the conduct of the audit

THE BOARD RECOGNISES AND MANAGES RISK

Qantas is committed to embedding risk management practices to

support the achievement of business objectives and ful l corporate

governance obligations. The Board is responsible for reviewing and

overseeing the risk management strategy for the Group. Management

has designed and implemented a risk management and internal control

system to manage Qantas’ material business risks.

Qantas is a complex business and faces a range of strategic, nancial

and operational risks and is not immune from the risks inherent in

operating in the aviation industry. To manage these and other risks, the

Board is responsible for reviewing and approving the Qantas Group Risk

Management Framework (Framework) which is underpinned by three

interrelated elements: governance, risk management and assurance.

The Board also reviews and approves the Qantas Group Risk

Management Policy (Policy) which sets out the minimum requirements

and roles and responsibilities for managing risk across the Qantas Group.

All employees have a responsibility to identify, report and/or manage risk

as it arises within the work environment. Summaries of the Policy and

other signi cant risk policies are included in the Qantas Group Business

Practices Document available in the Corporate Governance section on

the Qantas website.

The Qantas risk management and internal control system aligns to the

principles included in the Australian/New Zealand Standard on Risk

Management (AS/NZS ISO 31000:2009) and the Committee of

Sponsoring Organisations of the Treadway Commission (COSO)

framework for evaluating internal controls. The Qantas Management

System (QMS) provides a common standard for identifying, assessing

and managing material business risks across the Group. QMS provides

guidance for business units to adopt regarding leadership, commitment

and planning, process management, risk management, assurance and

training and promotion. QMS has already been implemented within all

operational areas of the Qantas Group and will be implemented to all

non-operational areas over the coming year.

Corporate Governance Statement continued