Memorex 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

A litigation settlement charge of $49.0 million was recorded in 2009. We entered into a confidential settlement

agreement ending all legal disputes with Philips Electronics N.V., U.S. Philips Corporation and North American Philips

Corporation (collectively, Philips). We had been involved in a complex series of disputes in multiple jurisdictions regarding

cross-licensing and patent infringement related to recordable optical media. The settlement provided resolution of all claims

and counterclaims filed by the parties without any finding or admission of liability or wrongdoing by any party. As a term of the

settlement, we agreed to pay Philips $53.0 million over a period of three years. Based on the present value of these

settlement payments, we recorded a charge of $49.0 million in the second quarter of 2009. We made payments of

$8.3 million, $8.2 million and $20.0 million in 2011, 2010 and 2009, respectively. Interest accretion of $1.2 million, $1.5 million

and $0.8 million was recorded in 2011, 2010 and 2009, respectively. The interest accretion is included in the interest expense

on our Consolidated Statements of Operations.

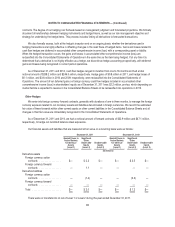

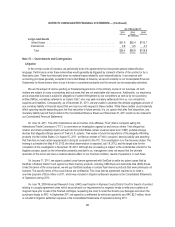

Operating Leases

We incur rent expense under operating leases, which primarily relate to equipment and office space. Most long-term

leases include one or more options to renew at the then fair rental value for a period of approximately one to three years. The

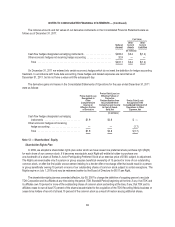

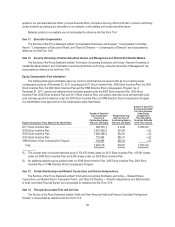

following table sets forth the components of rent expense for the years ended December 31:

2011 2010 2009

(In millions)

Minimum lease payments ............................................. $8.7 $ 9.6 $10.3

Contingent rentals ................................................... 4.5 7.2 18.0

Rental income ..................................................... (3.1) (2.9) (2.8)

Sublease income ................................................... (0.8) (0.5) (0.3)

Total rental expense ................................................. $9.3 $13.4 $25.2

Minimum lease payments and contingent rental expenses incurred due to agreements with warehouse providers are

included as a component of cost of goods sold in the Consolidated Statements of Operations. The minimum lease payments

under such arrangements were $0.8 million, $2.0 million and $2.2 million in 2011, 2010 and 2009, respectively. The

contingent rental expenses under such arrangements were $1.7 million, $3.6 million and $5.8 million in 2011, 2010 and 2009,

respectively.

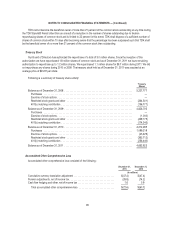

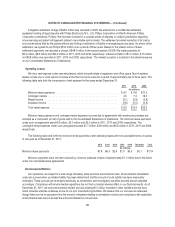

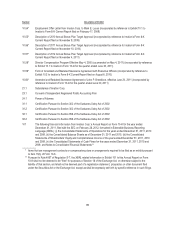

The following table sets forth the minimum rental payments under operating leases with non-cancelable terms in excess

of one year as of December 31, 2011:

2012 2013 2014 2015 2016 Thereafter Total

(In millions)

Minimum lease payments ................................. $7.8 $6.3 $2.4 $1.0 $0.3 $0.1 $17.9

Minimum payments have not been reduced by minimum sublease rentals of approximately $1.1 million due in the future

under non-cancelable lease agreements.

Environmental Matters

Our operations are subject to a wide range of federal, state and local environmental laws. Environmental remediation

costs are accrued when a probable liability has been determined and the amount of such liability has been reasonably

estimated. These accruals are reviewed periodically as remediation and investigatory activities proceed and are adjusted

accordingly. Compliance with environmental regulations has not had a material adverse effect on our financial results. As of

December 31, 2011, we had environmental-related accruals totaling $0.5 million recorded in other liabilities and we have

minor remedial activities underway at one of our prior manufacturing facilities. We believe that our accruals are adequate,

though there can be no assurance that the amount of expense relating to remediation actions and compliance with applicable

environmental laws will not exceed the amounts reflected in our accruals.

89