Memorex 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

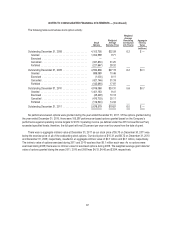

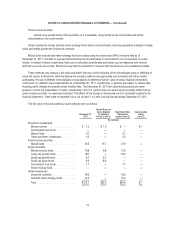

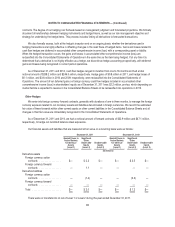

December 31,

2010

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant Other

Observable

Inputs (Level 2)

Unobservable

Inputs

(Level 3)

(In millions)

Short-term investments:

Money markets ................... $ 1.5 $ 1.5 $ — $—

Commingled trust funds ............. — — — —

Mutual funds ..................... 0.2 — 0.2 —

Other short-term investments ......... 0.2 — 0.2 —

Fixed income securities:

Mutual funds ..................... 35.6 13.2 22.4 —

Equity securities:

Blended mutual funds .............. 26.4 7.9 18.5 —

Large-cap growth funds ............. 18.3 — 18.3 —

Small-cap growth funds ............. 6.9 6.9 — —

Small-cap value funds .............. 6.8 6.8 — —

Commingled trust funds ............. 7.2 — 7.2 —

Growth mutual funds ............... 1.1 1.1 — —

Other investments:

Insurance contracts ................ 18.8 — 18.8 —

Absolute return strategy funds ........ 8.7 — 8.7 —

Total ........................... $131.7 $37.4 $94.3 $—

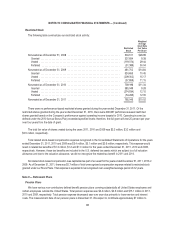

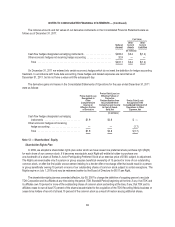

Employee Retirement Savings Plans

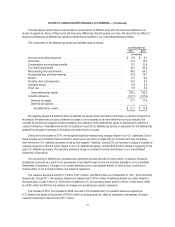

We sponsor a 401(k) retirement savings plan under which eligible United States employees may choose to save up to

20 percent of eligible compensation on a pre-tax basis, subject to certain IRS limitations. From January 1 to March 31, 2009,

we matched 100 percent of employee contributions up to the first three percent of eligible compensation plus 50 percent on

the next two percent of eligible compensation. Between April 2009 and December 31, 2009, we matched 50 percent of

employee contributions on the first three percent of eligible compensation and 25 percent on the next two percent of eligible

compensation in our stock. In November 2009, we determined it was appropriate to reinstate our 401(k) Plan matching

contribution to the rate applied prior to April 2009. The reinstatement became effective January 1, 2010 and continued

through December 31, 2010. Effective January 1, 2011, we match 100 percent of employee contributions up to the first five

percent of eligible compensation.

We also sponsor a variable compensation program in which we may, at our discretion, contribute up to three percent of

eligible employee compensation to employees’ 401(k) retirement accounts, depending upon total company performance. No

contributions have been made under the variable compensation program for the years ended 2011, 2010 or 2009.

We used shares of treasury stock to match employee 401(k) contributions for 2011, 2010 and 2009. Total expense

related to the use of shares of treasury stock to match employee 401(k) contributions was $2.1 million, $1.7 million and $1.3

million in 2011, 2010 and 2009, respectively.

75