Memorex 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

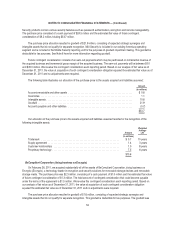

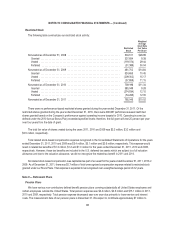

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

ended June 30, 2011 we demolished the building which resulted in a $7.0 million loss on disposal during the period. The land

related to the facility continues to meet the criteria for held for sale accounting and, therefore, remains classified in other current

assets on the Consolidated Balance Sheet as of December 31, 2011 at a book value of $0.2 million. On October 7, 2011 we

entered into an agreement to sell the land for $10.5 million, contingent upon the change of certain zoning requirements for the

land as well as other standard conditions. If these conditions are met, the sale is expected to close in 2013.

Also during 2011 we recorded acquisition and integration related costs as a result of our acquisition activities of $2.6

million within restructuring and other expense in the Consolidated Statements of Operations. Also during 2011 we amended a

long-term disability benefit plan, resulting in a $2.0 million gain.

During 2010, other expenses included costs associated with the announced retirement of our former Vice Chairman and

Chief Executive Officer, including a severance related charge of $1.4 million and a charge of $0.8 million related to the

accelerated vesting of his unvested options and restricted stock.

During 2009 we incurred net asset impairment charges of $2.7 million and other charges of $0.3 million related mainly to

the abandonment of certain manufacturing and R&D assets as a result of our restructuring activities.

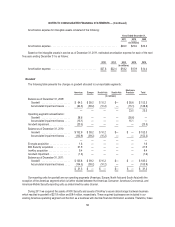

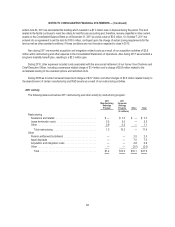

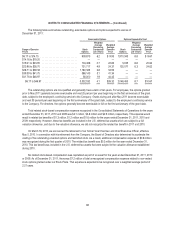

2011 Activity

The following table summarizes 2011 restructuring and other activity by restructuring program:

2011

Manufacturing

Redesign

Program

2011

Corporate

Strategy

Program Other Total

(In millions)

Restructuring

Severance and related .............................. $— $ 7.0 $ — $ 7.0

Lease termination costs ............................. 0.3 3.0 — 3.3

Other ........................................... 0.9 0.2 — 1.1

Total restructuring ............................... 1.2 10.2 — 11.4

Other

Pension settlement/curtailment ........................ — — 2.5 2.5

Asset disposals ................................... — — 7.0 7.0

Acquisition and integration costs ....................... — — 2.6 2.6

Other ........................................... — — (2.0) (2.0)

Total ......................................... $1.2 $10.2 $10.1 $21.5

63