Memorex 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

statement or in two separate but consecutive statements. Regardless of whether one or two statements are presented, an

entity is required to show reclassification adjustments on the face of the financial statements for items that are reclassified

from other comprehensive income to net income. On December 23, 2011, the FASB amended this guidance to indefinitely

defer provisions which require entities to present reclassification adjustments out of accumulated other comprehensive

income by component in both the statement in which net income is presented and the statement in which other

comprehensive income is presented (for both interim and annual financial statements). This guidance is effective for interim

and annual reporting periods beginning January 1, 2012. The adoption of this guidance will only change the presentation of

our Consolidated Statements of Shareholders’ Equity and Comprehensive Income.

In May 2011, the FASB issued amended disclosure requirements to provide a consistent definition of fair value and

ensure that the fair value measurement and disclosure requirements are similar between U.S. GAAP and IFRS. This

guidance changes certain fair value measurement principles and enhances the disclosure requirements particularly for Level

3 fair value measurements. This guidance is effective for reporting periods beginning January 1, 2012. We do not expect

these disclosures to have a material impact on our Consolidated Financial Statements.

A variety of proposed potential accounting standards are currently under study by standard setting organizations and

various regulatory agencies. Due to the tentative and preliminary nature of those proposed standards, management has not

determined whether implementation of such proposed standards would be material to our Consolidated Financial Statements.

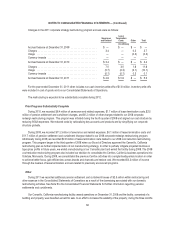

Note 3 — (Loss) Earnings per Common Share

Basic earnings per share is calculated using the weighted average number of shares outstanding for the period. Diluted

earnings per share is computed on the basis of the weighted average basic shares outstanding plus the dilutive effect of our

stock-based compensation plans using the “treasury stock” method. Unvested restricted stock and treasury shares are

excluded from the calculation of weighted average number of common stock outstanding because they do not participate in

dividends. Once restricted stock vests, it is included in our common stock outstanding.

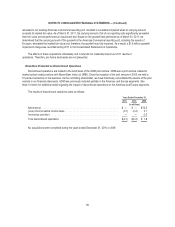

The following table sets forth the computation of the weighted average basic and diluted income (loss) per share:

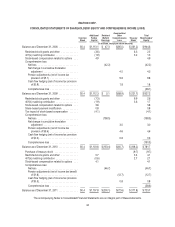

Years Ended December 31,

2011 2010 2009

(In millions)

Numerator:

Loss from continuing operations ................................... $(46.7) $(158.3) $(44.0)

(Loss) income from discontinued operations .......................... — (0.2 ) 1.8

Net loss ..................................................... $(46.7) $(158.5) $(42.2)

Denominator:

Weighted average number of common stock outstanding during the period . . . 37.7 37.8 37.5

Dilutive effect of stock-based compensation plans ...................... — — —

Weighted average number of diluted shares outstanding during the period .... 37.7 37.8 37.5

Basic (loss) earnings per common share:

Continuing operations ........................................... $(1.24) $ (4.19) $(1.17)

Discontinued operations ......................................... — (0.01) 0.05

Net loss ..................................................... (1.24) (4.19) (1.13)

Diluted (loss) earnings per common share:

Continuing operations ........................................... $(1.24) $ (4.19) $(1.17)

Discontinued operations ......................................... — (0.01) 0.05

Net loss ..................................................... (1.24) (4.19) (1.13)

Anti-dilutive options excluded from calculation ........................... 5.4 4.9 4.6

52