Memorex 2011 Annual Report Download - page 73

Download and view the complete annual report

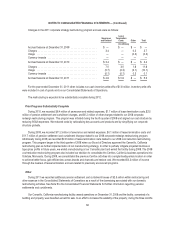

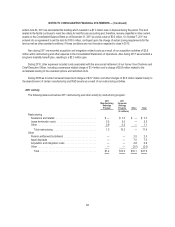

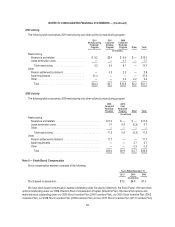

Please find page 73 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

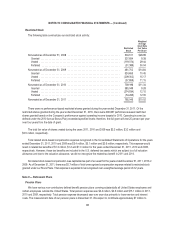

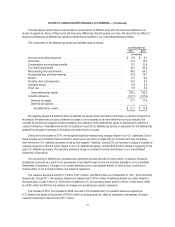

$10 million to our pension plans in 2012. It is our general practice, at a minimum, to fund amounts sufficient to meet the

requirements set forth in applicable benefits laws and local tax laws. From time to time, we contribute additional amounts, as

we deem appropriate.

In connection with actions taken under our previously announced restructuring programs, the number of employees

accumulating benefits under our pension plan in the United States has declined significantly. Participants in our U.S. pension

plan have the option of receiving cash lump sum payments when exiting the plan, which a number of participants exiting the

pension plan have elected to receive. Lump sum payments in 2011 exceeded our 2010 service and interest costs; as a result

a partial settlement event occurred and we recognized a pro-rata portion of the previously unrecognized net actuarial loss. We

incurred partial settlement losses of $2.5 million, $2.5 million and $7.1 million in 2011, 2010 and 2009, respectively, which are

included in restructuring and other expense on our Consolidated Statements of Operations. Further, as required by GAAP, we

remeasured the funded status of our United States plan as of the date of the settlements.

Effective January 1, 2010, the U.S. pension plan was amended to exclude new hires and rehires from participating in the

plan. Furthermore, we eliminated benefit accruals under the United States defined benefit pension plan as of January 1, 2011,

thus “freezing” the defined benefit pension plan. Under the plan freeze, no pay credits will be made to a participant’s account

balance after December 31, 2010. However, interest credits will continue in accordance with the annual update process. These

actions resulted in the recognition of all prior service cost as a curtailment loss of $0.3 million in 2010, included as a component of

restructuring and other in the Consolidated Statements of Operations. Due to the timing of this plan amendment we remeasured

the funded status of our U.S. pension plan in conjunction with the annual remeasurement as of December 31, 2010.

In connection with actions taken under our previously announced restructuring programs, we fully terminated a defined

benefit pension plan in Canada during the year ended December 31, 2009. We purchased annuities to fully fund our

obligation and removed the Company from future liability. A full settlement event occurred and we recognized the previously

unrecognized net actuarial position and incurred a settlement loss of $4.6 million, which is included in restructuring and other

expense on our Consolidated Statements of Operations.

For the U.S. pension plan, employees who have completed three years or more of service, including service with

3M Company before July 1, 1996, or who have reached age 65, are entitled to pension benefits beginning at normal

retirement age (65) based primarily on employees’ pay credits and interest credits. Through December 31, 2009, pay credits

were made to each eligible participant’s account equal to six percent of that participant’s eligible earnings for the year.

Beginning on January 1, 2010 and through December 31, 2010, pay credits were reduced to three percent of each

participant’s eligible earnings. In conjunction with the plan freeze, no additional pay credits will be made to a participant’s

account balance after December 31, 2010. A monthly interest credit is made to each eligible participant’s account based on

the participant’s account balance as of the last day of the preceding year. The interest credit rate is established annually and

is based on the interest rate of certain low-risk debt instruments. The interest credit rate was 4.19 percent for 2011. In

accordance with the annual update process, the interest credit rate will be 3.02 percent for 2012.

The U.S. pension plan permits four payment options: a lump-sum option, a life income option, a survivor option or a

period certain option. If a participant terminates prior to completing three years of service, the participant forfeits the right to

receive benefits under the pension plan unless the participant has reached the age of 65 at the time of termination.

70