Memorex 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

TDK cannot become the beneficial owner of more than 21 percent of the common stock outstanding at any time during

the TDK Standstill Period other than as a result of a reduction in the number of shares outstanding due to Imation

repurchasing shares of common stock and is limited to 22 percent in this event. TDK shall dispose of a sufficient number of

shares of common stock within 10 days after becoming aware that the percentage has been surpassed such that TDK shall

be the beneficial owner of no more than 21 percent of the common stock then outstanding.

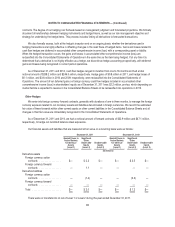

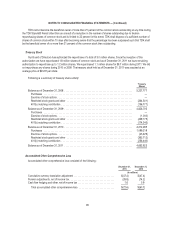

Treasury Stock

Our Board of Directors has authorized the repurchase of a total of 3.0 million shares. Since the inception of this

authorization we have repurchased 1.8 million shares of common stock and as of December 31, 2011 we have remaining

authorization to repurchase up to 1.2 million shares. We repurchased 1.1 million shares for $9.7 million during 2011. We did

not repurchase any shares during 2010 or 2009. The treasury stock held as of December 31, 2011 was acquired at an

average price of $23.97 per share.

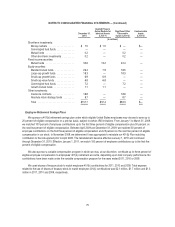

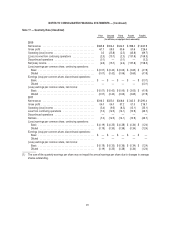

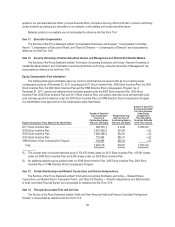

Following is a summary of treasury share activity:

Treasury

Shares

Balance as of December 31, 2008 .................................................. 5,227,777

Purchases ................................................................. —

Exercise of stock options ....................................................... —

Restricted stock grants and other ................................................ (264,301)

401(k) matching contribution .................................................... (136,771)

Balance as of December 31, 2009 .................................................. 4,826,705

Purchases ................................................................. —

Exercise of stock options ....................................................... (1,000)

Restricted stock grants and other ................................................ (439,175)

401(k) matching contribution .................................................... (174,245)

Balance as of December 31, 2010 .................................................. 4,212,285

Purchases ................................................................. 1,099,219

Exercise of stock options ....................................................... (45,429)

Restricted stock grants and other ................................................ (365,712)

401(k) matching contribution .................................................... (236,440)

Balance as of December 31, 2011 .................................................. 4,663,923

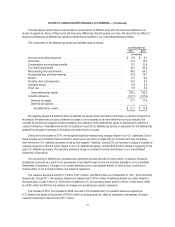

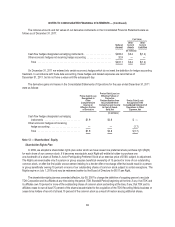

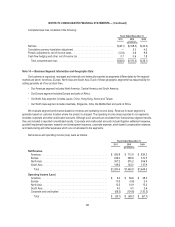

Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss consisted of the following:

December 31,

2011

December 31,

2010

(In millions)

Cumulative currency translation adjustment .............................. $(47.4) $(47.4)

Pension adjustments, net of income tax ................................. (26.8) (14.2)

Cash flow hedging and other, net of income tax ........................... 1.6 0.9

Total accumulated other comprehensive loss .......................... $(72.6) $(60.7)

85