Memorex 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

allocated to our existing Americas-Commercial reporting unit. Goodwill is considered impaired when its carrying amount

exceeds its implied fair value. As of March 31, 2011, the carrying amount of all of our reporting units significantly exceeded

their fair value and we performed an impairment test. Based on the goodwill test performed as of March 31, 2011, we

determined that the carrying amount of the goodwill in the Americas-Commercial reporting unit, including the assets of

Encryptx, exceeded the implied fair value and, therefore, the goodwill was fully impaired. As a result, a $1.6 million goodwill

impairment charge was recorded during 2011 in the Consolidated Statements of Operations.

The effects of these acquisitions individually and in total did not materially impact our 2011 results of

operations. Therefore, pro forma disclosures are not presented.

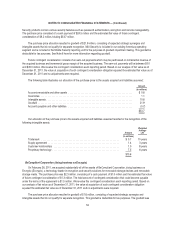

Divestiture Presented as Discontinued Operations

Discontinued operations are related to the wind down of the GDM joint venture. GDM was a joint venture created to

market optical media products with Moser Baer India Ltd. (MBI). Since the inception of the joint venture in 2003, we held a

51 percent ownership in the business. As the controlling shareholder, we have historically consolidated the results of the joint

venture in our financial statements. GDM was previously included partially in the Americas and Europe segments. See

Note 14 herein for additional detail regarding the impact of discontinued operations on the Americas and Europe segments.

The results of discontinued operations were as follows:

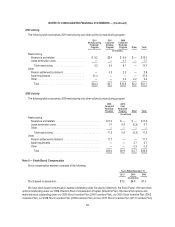

Years Ended December 31,

2011 2010 2009

(In millions)

Net revenue ....................................................... $ — $ — $74.5

(Loss) income before income taxes ...................................... (0.1) (0.2) 2.1

Income tax provision ................................................. — — 0.3

Total discontinued operations .......................................... $(0.1) $(0.2) $ 1.8

No acquisitions were completed during the years ended December 31, 2010 or 2009.

55