Memorex 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

unit’s goodwill is greater than the implied fair value of the reporting unit’s goodwill an impairment loss must be recognized for

the excess. This involves measuring the fair value of the reporting unit’s assets and liabilities (both recognized and

unrecognized) at the time of the impairment test. The difference between the reporting unit’s fair value and the fair values

assigned to the reporting unit’s individual assets and liabilities is the implied fair value of the reporting unit’s goodwill.

Our reporting units for goodwill are our operating segments (Americas, Europe, North Asia and South Asia) with the

exception of the Americas segment which is further divided between the Americas-Consumer, Americas-Commercial and

Mobile Security reporting units as determined by sales channel.

In evaluating whether goodwill was impaired, we compared the fair value of the Mobile Security reporting unit to its

carrying value (Step 1 of the impairment test). In calculating fair value, we used the income approach, a valuation technique

under which we estimate future cash flows using the reporting unit’s financial forecasts. Future estimated cash flows are

discounted to their present value to calculate fair value. In determining the fair value of the Mobile Security reporting unit

under the income approach, our expected cash flows are affected by various assumptions. Fair value on a discounted cash

flow basis uses forecasts over a 10 year period with an estimation of residual growth rates thereafter. We use our business

plans and projections as the basis for expected future cash flows. A discount rate of 16.5 percent was used to reflect the

relevant risks of the higher growth assumed for this reporting unit. An increase in the discount rate of one percent would have

decreased the reporting unit’s fair value by approximately $5.0 million while a decrease in the discount rate by one percent

would have increased the reporting unit’s fair value by $6.0 million. The revenue growth rates in 2012 through 2014 are

significant assumptions within the projections. If revenue were decreased 10 percent for each year without a change in

projected SG&A costs or other cash flows, the indicated fair value of the reporting unit would be reduced by approximately

$11.0 million.

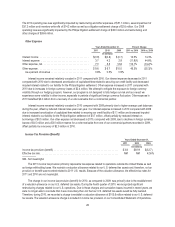

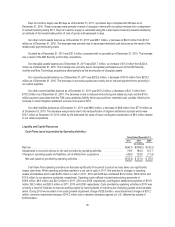

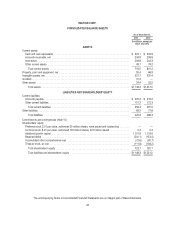

The indicated excess in fair value over carrying value of the Mobile Security reporting unit in step one of the impairment

test at November 30, 2011 and goodwill is as follows:

Goodwill

Reporting Unit

Carrying Amount

Excess of Fair

Value Over

Carrying Amount

Percentage of

Fair Value

Over Carrying Amount

(In millions)

Mobile Security ................................ $31.3 $52.0 $13.0 25%

While this analysis indicates that this goodwill is not impaired, to the extent that actual results or other assumptions

about future economic conditions or potential for our growth and profitability in this business changes, it is possible that our

conclusion regarding the remaining goodwill could change, which could have a material effect on our financial position and

results of operations.

During 2009 our reporting units for goodwill were our operating segments (Americas, Europe, Asia Pacific, and

Electronic Products) with the exception of the Americas segment which was further divided between the Americas-Consumer

and Americas-Commercial reporting units as determined by sales channel. During the second quarter of 2010 we realigned

our corporate segments and reporting structure and combined our Electronic Products segment with our Americas segment,

and we separated our Asia Pacific segment into North Asia and South Asia regions. As a result of the segment change, the

goodwill of $23.5 million which was previously allocated to the Electronics Products segment was merged into the Americas-

Consumer reporting unit. The Americas-Consumer reporting unit had a fair value that was significantly less than its carrying

amount prior to the combination, which is a triggering event for an interim goodwill impairment test. A two-step impairment test

was performed to identify a potential impairment and measure an impairment loss to be recognized. Based on this step of the

impairment test, we determined that the full amount of remaining goodwill, $23.5 million, was impaired.

Excess Inventory and Obsolescence. We write down our inventory for excess, slow moving and obsolescence to the

net realizable value based upon assumptions about future demand and market conditions. If actual market conditions are less

favorable than those we project, additional write-downs may be required. As of December 31, 2011, the estimated inventory

write-downs for excess inventory and obsolescence for inventory on hand was $43.4 million.

36