Memorex 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2011 Manufacturing Redesign Restructuring Program

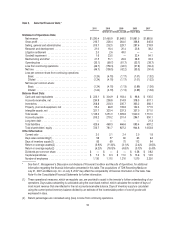

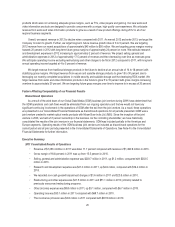

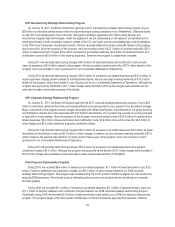

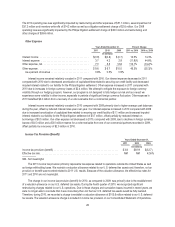

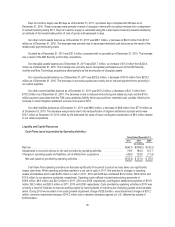

On January 13, 2011, the Board of Directors approved a 2011 manufacturing redesign restructuring program of up to

$55 million to rationalize certain product lines and discontinue tape coating operations at our Weatherford, Oklahoma facility

by April 2011 and subsequently close the facility. We signed a strategic agreement with TDK to jointly develop and

manufacture magnetic tape technologies. Under the agreement, we are collaborating on the research and development of

future tape formats in both companies’ research centers in the U.S. and Japan and we consolidated tape coating operations

to the TDK Group Yamanashi manufacturing facility. We also recorded additional inventory write-offs related to this program

due to end of life. Since the inception of this program, we have recorded a total of $21.7 million of inventory write-offs, $31.2

million of asset impairment charges, $3.2 million of severance and related expenses, $0.3 million for lease termination and

modification costs and $0.9 million of site clean-up expenses. Therefore this program is substantially complete.

During 2011 we recorded restructuring charges of $0.3 million for lease termination and modification costs and site

clean-up expenses of $0.9 million related to this program. We also recorded inventory write-offs of $7.5 million related to this

program, which are included in cost of goods sold on our Consolidated Statements of Operations.

During 2010 we recorded restructuring charges of $3.2 million for severance and related expenses and $31.2 million of

asset impairment charges primarily related to the Weatherford facility. We also recorded inventory write-offs of $14.2 million

related to this program, which are included in cost of goods sold on our Consolidated Statements of Operations. Although this

program was approved by the Board in 2011, these charges were recorded in 2010 as the charges were probable and we

were able to make a reasonable estimate of the liability.

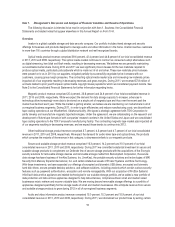

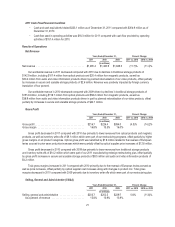

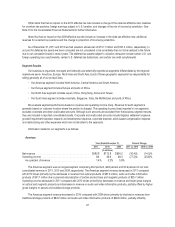

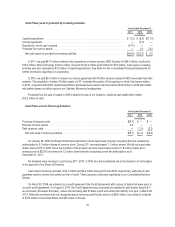

2011 Corporate Strategy Restructuring Program

On January 31, 2011, the Board of Directors approved the 2011 corporate strategy restructuring program of up to $35

million to rationalize certain product lines and increase efficiency and gain greater focus in support of our go-forward strategy.

Major components of the program include charges associated with certain benefit plans, improvements to our global sourcing

and distribution network and costs associated with both further rationalization of our product lines as well as evolving skill sets

to align with our new strategy. Since the inception of this program, we have recorded a total of $10.4 million of severance and

related expenses, $3.0 million of lease termination and modification costs, $1.6 million of inventory write-offs, $0.2 million of

other charges and $0.3 million related to a pension curtailment charge.

During 2011 we recorded restructuring charges of $7.0 million for severance and related expenses, $3.0 million for lease

termination and modification costs and $0.2 million of other charges. In addition, we also recorded inventory write-offs of $1.6

million related to the planned rationalization of certain product lines as part of this program, which are included in cost of

goods sold in our Consolidated Statements of Operations.

During 2010 we recorded restructuring charges of $3.4 million for severance and related expenses and a pension

curtailment charge of $0.3 million. Although this program was approved by the Board in 2011, these charges were recorded in

2010 as the charges were probable and we were able to make a reasonable estimate of the liability.

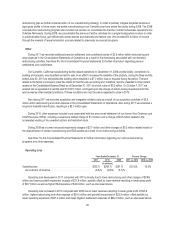

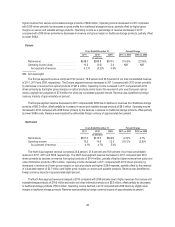

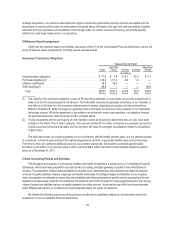

Prior Programs Substantially Complete

During 2010, we recorded $6.4 million of severance and related expenses, $1.7 million of lease termination costs, $2.5

million of pension settlement and curtailment charges, and $0.2 million of other charges related to our 2008 corporate

redesign restructuring program. This program was initiated during the fourth quarter of 2008 and aligned our cost structure by

reducing SG&A expenses. We reduced costs by rationalizing key accounts and products and by simplifying our corporate

structure globally.

During 2009, we recorded $11.2 million of severance and related expenses, $0.1 million of lease termination costs and

$11.7 million of pension settlement and curtailment charges related to our 2008 corporate redesign restructuring program.

Additionally during 2009, we recorded $0.9 million of lease termination costs related to our 2008 cost reduction restructuring

program. This program began in the third quarter of 2008 when our Board of Directors approved the Camarillo, California

24