Memorex 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

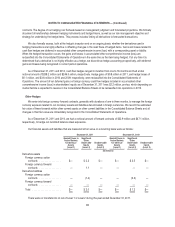

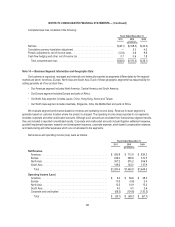

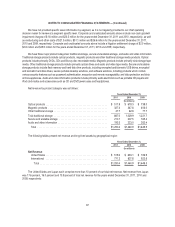

As of December 31,

2011 2010 2009

(In millions)

Long-Lived Assets

United States ................................................... $51.6 $62.4 $105.1

International .................................................... 3.8 4.5 4.7

Total ....................................................... $55.4 $66.9 $109.8

Note 15 — Commitments and Contingencies

Litigation

In the normal course of business, we periodically enter into agreements that incorporate general indemnification

language. Performance under these indemnities would generally be triggered by a breach of terms of the contract or by a

third-party claim. There has historically been no material losses related to such indemnifications. In accordance with

accounting principles generally accepted in the United States of America, we record a liability in our Consolidated Financial

Statements for these actions when a loss is known or considered probable and the amount can be reasonably estimated.

We are the subject of various pending or threatened legal actions in the ordinary course of our business. All such

matters are subject to many uncertainties and outcomes that are not predictable with assurance. Additionally, our electronics

and accessories business is subject to allegations of patent infringement by our competitors as well as by non-practicing

entities (NPEs), sometimes referred to as “patent trolls,” who may seek monetary settlements from us, our competitors,

suppliers and resellers. Consequently, as of December 31, 2011, we are unable to ascertain the ultimate aggregate amount of

any monetary liability or financial impact that we may incur with respect to these matters. While these matters could materially

affect operating results depending upon the final resolution in future periods, it is our opinion that after final disposition, any

monetary liability beyond that provided in the Consolidated Balance Sheet as of December 31, 2011 would not be material to

our Consolidated Financial Statements.

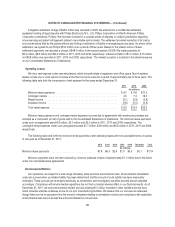

On June 14, 2011, Trek 2000 International Ltd and certain of its affiliates (“Trek”) filed a complaint asking the

International Trade Commission (“ITC”) to commence an investigation against us and various others. Trek alleges that

Imation and others unlawfully import and sell into the United States certain universal serial bus (“USB”) portable storage

devices that allegedly infringe several of Trek’s U.S. patents. Trek seeks to block the importation of the allegedly offending

products into the United States. On August 15, 2011, we filed an answer to Trek’s complaint, denying liability and asserting

that Trek fails to meet certain requirements to bring its complaint to the ITC. This investigation is in the discovery phase. The

hearing is scheduled for May 9-16, 2012; the initial determination is expected July 19, 2012; and the target date for the

completion of this investigation is November 19, 2012. Although this proceeding is subject to the uncertainties inherent in the

litigation process, based on the information presently available to us, management does not expect that the ultimate

resolution of this action will have a material adverse effect on our financial condition, results of operations or cash flows.

On January 11, 2011, we signed a patent cross-license agreement with SanDisk to settle two patent cases filed by

SanDisk in Federal District Court against our flash memory products, including USB drives and solid state disk (SSD) drives.

Under the terms of the cross-license, we will pay SanDisk royalties on certain flash memory products that were previously not

licensed. The specific terms of the cross-license are confidential. The cross-license agreement required us to make a

one-time payment of $2.6 million in 2011, which was included in litigation settlement expense in the Consolidated Statements

of Operations during 2010.

On June 19, 2009 Advanced Research Corp. (ARC) sued Imation in Ramsey County District Court for breach of contract

relating to a supply agreement under which we purchased our requirements for magnetic heads to write servo patterns on

magnetic tape prior to sale of the finished cartridges, requesting the court to order that Imation pay damages and return the

purchased heads to ARC. In September 2011 we agreed to a settlement by which we agreed to pay ARC $2.0 million, which

is included in litigation settlement expense in the Consolidated Statements of Operations during 2011.

88