Memorex 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion is intended to be read in conjunction with Item 1. Business, the Consolidated Financial

Statements and related notes that appear elsewhere in this Annual Report on Form 10-K.

Overview

Imation is a global scalable storage and data security company. Our portfolio includes tiered storage and security

offerings for business and products designed to manage audio and video information in the home. Imation reaches customers

in more than 100 countries through a global distribution network and well recognized brands.

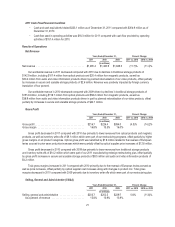

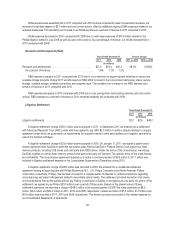

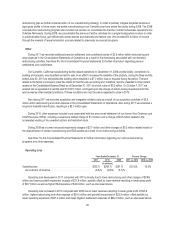

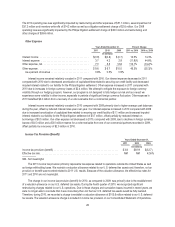

Optical media product revenue comprised 39.6 percent, 42.4 percent and 44.8 percent of our total consolidated revenue

in 2011, 2010 and 2009, respectively. The optical media market continues to contract as consumers adopt alternatives such

as digital streaming, hard disk and flash media, resulting in decreasing revenues. We believe we are generally maintaining

our worldwide market share. During 2010 and 2011 we saw significant price increases for the raw materials required to

produce optical media, particularly polycarbonate which is made out of oil and silver. These raw materials price increases

were passed on to us in 2011 by our suppliers, mitigated partially by successfully negotiated price increases with our

customers, causing gross margin pressures. The contracting optical media market size and increasing raw materials prices

impacted all of our segments resulting in decreasing revenues and gross margins. During 2011, we reversed $7.8 million of

accruals related to prior year European optical media copyright levies payable for which we considered payment remote. See

Note 2 to the Consolidated Financial Statements for further information regarding levies.

Magnetic product revenue comprised 25.4 percent, 23.8 percent and 24.6 percent of our total consolidated revenue in

2011, 2010 and 2009, respectively. While we expect the demand for data storage capacity to increase, advances in

technology allow increasingly more data to be stored on a single unit of magnetic tape and thus over the recent past the

market has declined each year. While the market is getting smaller, we believe we are maintaining our market share in all of

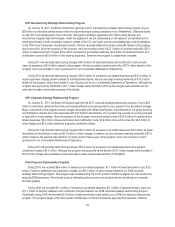

our regional business segments. During 2011, in order to gain efficiencies and reduce manufacturing costs, we discontinued

tape coating operations at our Weatherford, Oklahoma facility. We signed a strategic agreement with TDK Corporation to

jointly develop and manufacture magnetic tape technologies. Under the agreement, we are collaborating on the research and

development of future tape formats in both companies’ research centers in the United States and Japan and we consolidated

tape coating operations to the TDK Yamanashi manufacturing facility. The contracting magnetic tape market size impacted all

of our segments resulting in decreasing revenues, and we expect these trends to continue into 2012.

Other traditional storage product revenue comprised 3.7 percent, 4.3 percent and 4.7 percent of our total consolidated

revenue in 2011, 2010 and 2009, respectively. We expect the demand for audio video tape and optical drives, the products

which comprise the majority of the revenue in this category, to decrease similarly to our magnetic products.

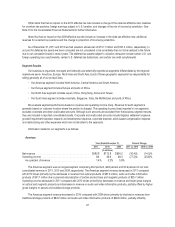

Secure and scalable storage product revenue comprised 16.3 percent, 14.2 percent and 10.0 percent of our total

consolidated revenue in 2011, 2010 and 2009, respectively. During 2011 we committed substantial investment in secure and

scalable storage products to complement our Defender line of secure storage products with the acquisitions of the Encryptx

security solutions for removable storage devices and removable storage media from BeCompliant Corporation, the secure

data storage hardware business of IronKey Systems, Inc. (IronKey), the portable security solutions and technologies of MXI

Security from Memory Experts International, Inc. and certain intellectual assets of Prostor Systems and Nine Technology.

With these investments, we have expanded our offerings of encrypted and biometric USB drives, encrypted and biometric

hard disk drives, secure portable desktop solutions, and software solutions, including products which contain various security

features such as password authentication, encryption and remote manageability. With our acquisition of ProStor Systems’

InfiniVault data-archive appliance and related technologies for our scalable storage portfolio, we’ve added a new portfolio of

data protection and data archive appliances designed to help data-intensive, compliance-driven small and medium sized

businesses retain, retrieve and recover valuable data. We are moving beyond removable storage offerings to a portfolio of

appliances designed specifically for the storage needs of small and medium businesses. We anticipate revenue from secure

and scalable storage products to grow during 2012 in all of our regional business segments.

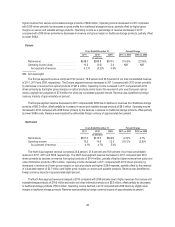

Audio and video information product revenue comprised 15.0 percent, 15.3 percent and 15.9 percent of our total

consolidated revenue in 2011, 2010 and 2009, respectively. During 2011, we rationalized our product lines by exiting certain

19