Memorex 2011 Annual Report Download - page 51

Download and view the complete annual report

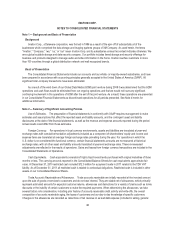

Please find page 51 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

unit to which goodwill was assigned to its carrying amount. If fair value is deemed to be less than carrying value, the second

step of the impairment test compares the implied fair value of the reporting unit’s goodwill with the carrying amount of the

reporting unit’s goodwill. If the carrying amount of the reporting unit’s goodwill is greater than the implied fair value of the

reporting unit’s goodwill an impairment loss must be recognized for the excess. This involves measuring the fair value of the

reporting unit’s assets and liabilities (both recognized and unrecognized) at the time of the impairment test. The difference

between the reporting unit’s fair value and the fair values assigned to the reporting unit’s individual assets and liabilities is the

implied fair value of the reporting unit’s goodwill.

Our reporting units for goodwill are our operating segments (Americas, Europe, North Asia and South Asia) with the

exception of the Americas segment which is further divided between the Americas-Consumer, Americas-Commercial and

Mobile Security reporting units as determined by sales channel. At December 31, 2011, the only reporting unit which had

goodwill was Mobile Security.

In evaluating whether goodwill was impaired, we compared the fair value of the Mobile Security reporting unit to it’s

carrying value (Step 1 of the impairment test). In calculating fair value, we used the income approach, a valuation technique

under which we estimate future cash flows using the reporting unit’s financial forecasts. Future estimated cash flows are

discounted to their present value to calculate fair value. In determining the fair value of the Mobile Security reporting unit

under the income approach, our expected cash flows are affected by various assumptions. Fair value on a discounted cash

flow basis uses forecasts over a 10 year period with an estimation of residual growth rates thereafter. We use our business

plans and projections as the basis for expected future cash flows. A discount rate of 16.5 percent was used to reflect the

relevant risks of the higher growth assumed for this reporting unit. The revenue growths in 2012 through 2014 are significant

assumptions within the projections. Based on the goodwill test performed, we determined that the fair value of the reporting

unit exceeded its carrying amount. See Note 6 herein for additional information.

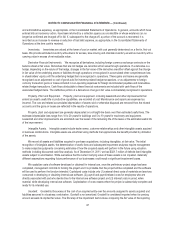

Impairment of Long-Lived Assets. We periodically review the carrying value of our property and equipment and our

intangible assets to test whether current events or circumstances indicate that such carrying value may not be recoverable. If

the tests indicate that the carrying value of the asset is greater than the expected undiscounted cash flows to be generated by

such asset or asset group, an impairment loss would be recognized. The impairment loss is determined by the amount by

which the carrying value of such asset or asset group exceeds its fair value. We generally measure fair value by considering

sale prices for similar assets or by discounting estimated future cash flows from such assets using an appropriate discount

rate. Assets to be disposed of are carried at the lower of their carrying value or fair value less costs to sell. Considerable

management judgment is necessary to estimate the fair value of assets and, accordingly, actual results could vary

significantly from such estimates.

In conjunction with the 2011 manufacturing redesign restructuring program announced in January 2011, certain assets

held primarily at our Weatherford, Oklahoma facility were determined to be impaired in accordance with the provisions of

impairment of long-lived assets. These long-lived assets held and used include the property, building and equipment primarily

related to the manufacturing of magnetic tape which was consolidated to the TDK Group Yamanashi manufacturing facility in

April 2011. TDK Corporation (TDK) is a related party to Imation. These assets had a carrying amount of $17.0 million and

were written down to their fair value of $2.3 million, resulting in an impairment charge of $14.7 million during 2010. The fair

value of the equipment was assessed based upon sales proceeds from similar equipment sold as part of the closing of our

Camarillo, California facility. These assets had a carrying amount of $17.3 million and were written down to their fair value of

$0.8 million, resulting in an impairment charge of $16.5 million during 2010. The impairments were recorded as part of

restructuring and other charges in the Consolidated Statements of Operations in 2010.

As of June 30, 2011, the Weatherford facility met the criteria for classification as held for sale outlined in the accounting

guidance for the sale of a long-lived asset. Accordingly, the book value of the building and property were transferred into other

current assets on the Consolidated Balance Sheets and is no longer being depreciated.

Revenue Recognition. We sell a wide range of removable data storage media products as well as certain consumer

electronic products. Net revenue consists primarily of magnetic, optical, flash media, consumer electronics and accessories

48