Memorex 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

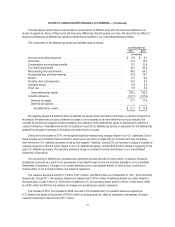

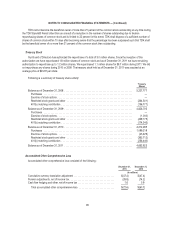

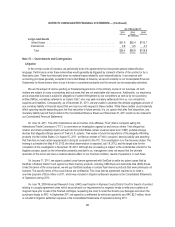

$321.7 million and $320.4 million at December 31, 2011 and 2010, respectively. The inputs used in the fair value analysis fall

within Level 3 of the fair value hierarchy due to the use of significant unobservable inputs to determine fair value. Based upon

the testing performed in 2011 and 2010, no impairment of intangible assets was deemed to have occurred.

The Company assesses the impairment of property, plant, and equipment whenever events or changes in

circumstances indicate that the carrying amount of property, plant, and equipment assets may not be recoverable. As part of

the Company’s 2011 manufacturing redesign restructuring program, the Company recorded property, plant, and equipment

impairments of $14.7 million in 2010 related to the Weatherford, Oklahoma facility. See Note 7 herein for further discussion of

the previously announced restructuring initiatives.

During 2011 we acquired MXI Security and IronKey which resulted in goodwill of $21.9 million and $9.4 million,

respectively. Also during 2011 we acquired Encryptx which resulted in goodwill of $1.6 million. In accordance with the

accounting provisions for goodwill, goodwill related to the Encryptx acquisition was written-off as the carrying amount of our

Americas-Commercial reporting unit, including Encryptx, significantly exceeded the implied fair value. This resulted in an

impairment charge of $1.6 million, which was included in earnings in 2011. See Note 6 herein for further information regarding

the assumptions used to assess this impairment.

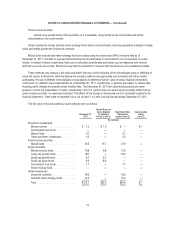

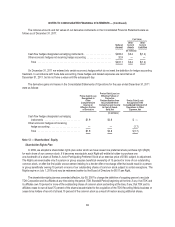

Assets and Liabilities that are Measured at Fair Value on a Recurring Basis

The assets in our postretirement benefit plans are measured at fair value on a recurring basis (at least annually). See

Note 9 herein for additional discussion concerning pension and postretirement benefit plans.

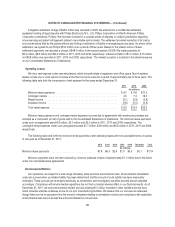

We revalue the contingent consideration obligation for acquisitions completed on a recurring basis each reporting

period. Changes in the fair value of our contingent consideration obligations are recognized as a fair value adjustment of

contingent consideration within our consolidated statements of income. These fair value measurements are based on

significant inputs not observable in the market and therefore represent Level 3 measurements. The total of such contingent

consideration obligations at December 31, 2011 was $10.5 million, related to our acquisitions of MXI Security and Encryptx in

the amounts of $9.2 million and $1.3 million, respectively. Based on our analysis of fair value as of December 31, 2011, the

value at acquisition of such contingent consideration obligations equaled the estimated fair value as of December 31, 2011

and no adjustments were required.

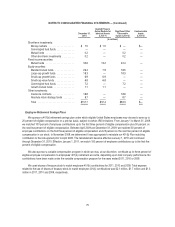

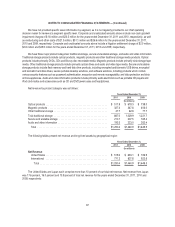

We maintain a foreign currency exposure management policy that allows the use of derivative instruments, principally

foreign currency forward, option contracts and option combination strategies to manage risks associated with foreign

exchange rate volatility. Generally, these contracts are entered into to fix the U.S. dollar amount of the eventual cash flows.

The derivative instruments range in duration at inception from less than one to sixteen months. We do not hold or issue

derivative financial instruments for speculative or trading purposes and we are not a party to leveraged derivatives.

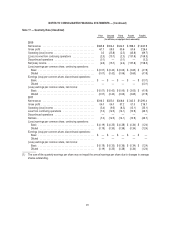

As of December 31, 2011, we held derivative instruments that are required to be measured at fair value on a recurring

basis. Our derivative instruments consist of foreign currency forwards, option contracts and option combination strategies.

The fair value of our derivative instruments is determined based on inputs that are observable in the public market, but are

other than publicly quoted prices (Level 2).

We are exposed to the risk of nonperformance by our counter-parties in foreign currency forward and option contracts,

but we do not anticipate nonperformance by any of these counter-parties. We actively monitor our exposure to credit risk

through the use of credit approvals and credit limits and by using major international banks and financial institutions as

counter-parties.

Cash Flow Hedges

We attempt to substantially mitigate the risk that forecasted cash flows denominated in foreign currencies may be

adversely affected by changes in currency exchange rates through the use of option, forward and combination option

82