Memorex 2011 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SG&A expense was essentially flat in 2011 compared with 2010 and was impacted by lower compensation expense, the

reversal of a bad debt reserve of $2.7 million and cost control actions, offset by additional ongoing SG&A expenses related to our

acquired businesses. This resulted in an increase in our SG&A expense as a percent of revenue in 2011 compared to 2010.

SG&A expense decreased in 2010 compared with 2009 due to lower legal expenses of $10.5 million related to the

Philips litigation settled in July 2009 as well as cost control actions. As a percentage of revenue, our SG&A remained flat in

2010 compared with 2009.

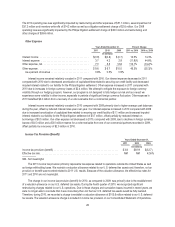

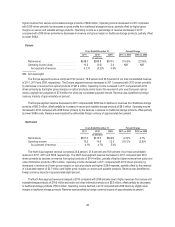

Research and Development (R&D)

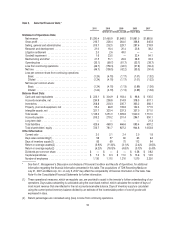

Years Ended December 31, Percent Change

2011 2010 2009 2011 vs. 2010 2010 vs. 2009

(In millions)

Research and development .............................. $21.0 $16.4 $20.4 28.0% (19.6)%

As a percent of revenue ............................... 1.6% 1.1% 1.2%

R&D expense increased in 2011 compared with 2010 due to our investment to support growth initiatives in secure and

scalable storage products. During 2011 we refocused our R&D effort to invest in four core product technology areas: secure

storage, scalable storage, wireless/connectivity and magnetic tape. This resulted in an increase in our R&D expense as a

percent of revenue in 2011 compared with 2010.

R&D expense decreased in 2010 compared with 2009 due to cost savings from restructuring activities and cost control

actions. R&D expense as a percent of revenue in 2010 remained relatively flat compared with 2009.

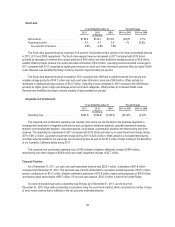

Litigation Settlements

Years Ended December 31,

2011 2010 2009

(In millions)

Litigation settlements .......................................................... $2.0 $2.6 $49.0

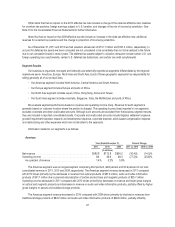

A litigation settlement charge of $2.0 million was recognized in 2011. In September 2011 we entered into a settlement

with Advanced Research Corp. (ARC) under which we agreed to pay ARC $2.0 million to settle a dispute relating to a supply

agreement under which we purchased our requirements for magnetic heads to write servo patterns on magnetic tape prior to

sale of the finished cartridges.

A litigation settlement charge of $2.6 million was recognized in 2010. On January 11, 2011, we signed a patent cross-

license agreement with SanDisk to settle the two patent cases filed by SanDisk in Federal District Court against our flash

memory products, including USB drives and solid state disk (SSD) drives. Under the terms of the cross-license, we will pay

SanDisk royalties on certain flash memory products that were previously not licensed. The specific terms of the cross-license

are confidential. The cross-license agreement required us to make a one-time payment of $2.6 million in 2011, which was

included in litigation settlement expense in the Consolidated Statements of Operations during 2010.

A litigation settlement charge of $49.0 million was recorded in 2009. We entered into a confidential settlement

agreement ending all legal disputes with Philips Electronics N.V., U.S. Philips Corporation and North American Philips

Corporation (collectively, Philips). We had been involved in a complex series of disputes in multiple jurisdictions regarding

cross-licensing and patent infringement related to recordable optical media. The settlement provided resolution of all claims

and counterclaims filed by the parties without any finding or admission of liability or wrongdoing by any party. As a term of the

settlement, we agreed to pay Philips $53.0 million over a period of three years. Based on the present value of these

settlement payments, we recorded a charge of $49.0 million in the second quarter of 2009. We made payments of $8.3

million, $8.2 million and $20.0 million in 2011, 2010 and 2009, respectively. Interest accretion of $1.2 million, $1.5 million and

$0.8 million was recorded in 2011, 2010 and 2009, respectively. The interest accretion is included in the interest expense on

our Consolidated Statements of Operations.

22