Memorex 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Security products contain various security features such as password authentication, encryption and remote manageability.

The purchase price consisted of a cash payment of $24.5 million and the estimated fair value of future contingent

consideration of $9.2 million, totaling $33.7 million.

The purchase price allocation resulted in goodwill of $21.9 million, consisting of expected strategic synergies and

intangible assets that do not qualify for separate recognition. MXI Security is included in our existing Americas operating

segment and is included in the Mobile Security reporting unit for the purposes of goodwill impairment testing. This goodwill is

deductible for tax purposes. See Note 6 here for more information regarding goodwill.

Future contingent consideration consists of an earn-out payments which may be paid based on incremental revenue of

the acquired business and incremental gross margin of the acquired business. The earn-out payments will be between $0.0

and $45.0 million. We revalue this contingent consideration each reporting period. Based on our analysis of fair value as of

December 31, 2011, the value at acquisition of such contingent consideration obligation equaled the estimated fair value as of

December 31, 2011 and no adjustments were required.

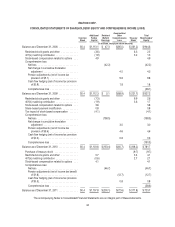

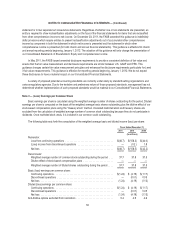

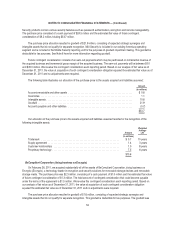

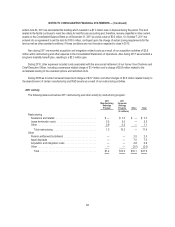

The following table illustrates our allocation of the purchase price to the assets acquired and liabilities assumed:

Amount

(In millions)

Accounts receivable and other assets ............................................... $ 0.8

Inventories ................................................................... 1.1

Intangible assets ............................................................... 10.6

Goodwill ..................................................................... 21.9

Accounts payable and other liabilities ............................................... (0.7)

$33.7

Our allocation of the purchase price to the assets acquired and liabilities assumed resulted in the recognition of the

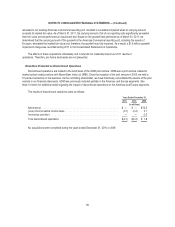

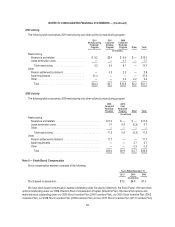

following intangible assets:

Amount

Weighted

Average

Life

(In millions)

Trademark ......................................................... $ 0.7 10years

Supply agreement .................................................... 1.4 3years

Customer relationships ................................................ 1.0 8years

Proprietary technology ................................................. 7.5 6years

$10.6

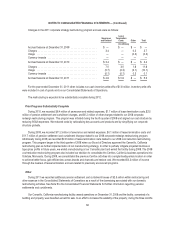

BeCompliant Corporation (doing business as Encryptx)

On February 28, 2011, we acquired substantially all of the assets of BeCompliant Corporation, doing business as

Encryptx (Encryptx), a technology leader in encryption and security solutions for removable storage devices and removable

storage media. The purchase price was $2.3 million, consisting of a cash payment of $1.0 million and the estimated fair value

of future contingent consideration of $1.3 million. The total amount of contingent consideration that could become payable

under the terms of the agreement is $1.5 million. We revalue this contingent consideration each reporting period. Based on

our analysis of fair value as of December 31, 2011, the value at acquisition of such contingent consideration obligation

equaled the estimated fair value as of December 31, 2011 and no adjustments were required.

The purchase price allocation resulted in goodwill of $1.6 million, consisting of expected strategic synergies and

intangible assets that do not qualify for separate recognition. This goodwill is deductible for tax purposes. The goodwill was

54