Logitech 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

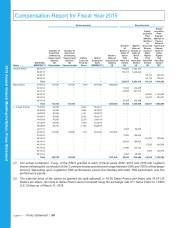

Compensation Report for Fiscal Year 2015

81 | – Proxy Statement

2015 Annual General Meeting Invitation, Proxy Statement

In fiscal year 2015, grants were made to new hires

and promoted employees through regularly scheduled

monthly written consents of the Compensation

Committee. We do not have any program, plan, or practice

to select equity compensation grant dates in coordination

with the release of material non-public information, nor

do we time the release of information for the purpose

of affecting value. We do not backdate options or grant

options retroactively.

Derivatives Trading, Hedging, and Pledging Policies

We have adopted a policy prohibiting our employees,

including our executive officers, and members of

our Board of Directors from speculating in our equity

securities, including the use of short sales, “sales against

the box” or any equivalent transaction involving our

equity securities. In addition, they may not engage in any

other hedging transactions, such as “cashless” collars,

forward sales, equity swaps and other similar or related

arrangements, with respect to the securities that they

hold. Finally, no employee, including an executive officer

or member of our Board of Directors may acquire, sell, or

trade in any interest or position relating to the future price

of our equity securities.

We also have adopted a policy prohibiting the pledging of

our securities by our employees, including our executive

officers, and members of our Board of Directors.

Tax and Accounting Considerations

Deductibility of Executive Compensation

Favorable accounting and tax treatment of the various

elements of our compensation program is a relevant

consideration in their design. However, the Company

and the Compensation Committee have placed a higher

priority on structuring flexible compensation programs to

promote the recruitment, retention, and performance of

our officers than on maximizing tax deductibility. Section

162(m) of the Code, as amended (the “Tax Code”), places

a limit of $1 million on the amount of compensation that

Logitech may deduct in any one year with respect to

certain executive officers. The Compensation Committee

has the ability through the use of Logitech International

S.A. 2006 Stock Incentive Plan to grant awards that

qualify as “performance-based compensation” exempt

from that $1 million limitation but, to maintain flexibility in

compensating executive officers in a manner designed

to promote varying corporate goals, the Compensation

Committee has not adopted a policy requiring all

compensation to be deductible, and has in the past and

will in the future make compensation awards that do not

qualify to be exempt from the $1 million limitation when

it believes that it is appropriate to meet its compensation

objectives.

In addition to considering the tax consequences, the

Compensation Committee considers the accounting

consequences, including the impact of the Financial

Accounting Standard Board’s Accounting Standards

Codification Section 718, on its decisions in determining

the forms of different equity awards.