Logitech 2015 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

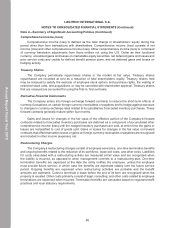

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

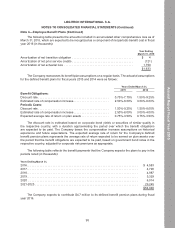

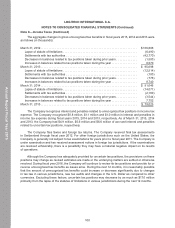

Deferred Compensation Plan

One of the Company’s subsidiaries offers a deferred compensation plan that permits eligible

employees to make 100% vested salary and incentive compensation deferrals within established limits.

The Company does not make contributions to the plan.

The fair value of the deferred compensation plan’s assets is included in other assets on the

consolidated balance sheets. The marketable securities are classified as trading investments and were

recorded at a fair value of $17.2 million and $16.6 million as of March 31, 2015 and 2014, respectively, based

on quoted market prices. The Company also had $17.2 million and $16.6 million deferred compensation

liability as of March 31, 2015 and 2014, respectively. Earnings, gains and losses on trading investments

are included in other income (expense), net and corresponding changes in deferred compensation liability

are included in operating expenses and cost of goods sold.

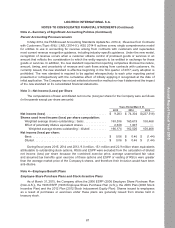

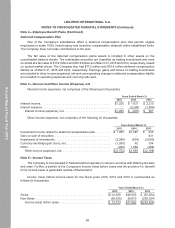

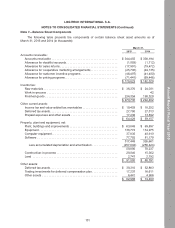

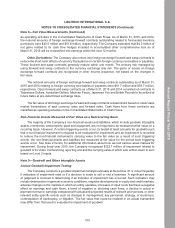

Note 5—Interest and Other Income (Expense), net

Interest income (expense), net comprises of the following (in thousands):

Years Ended March 31,

2015 2014 2013

Interest income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,225 $ 1,831 $ 2,215

Interest expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (2,228) (1,308)

Interest income (expense), net . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,225 $ (397) $ 907

Other income (expense), net comprises of the following (in thousands):

Years Ended March 31,

2015 2014 2013

Investment income related to deferred compensation plan . . . . . . . . . $ 1,055 $1,487 $ 933

Gain on sale of securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 831

Impairment of investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,298) (624) (3,600)

Currency exchange gain (loss), net . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,280) 62 104

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (229) 1,068 (466)

Other income (expense), net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(2,752) $1,993 $(2,198)

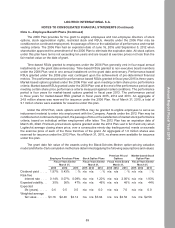

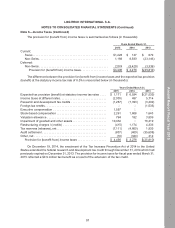

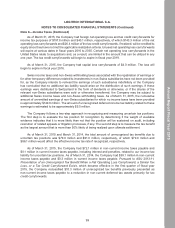

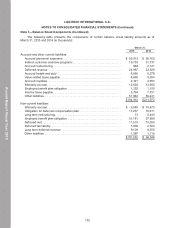

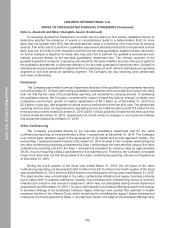

Note 6—Income Taxes

The Company is incorporated in Switzerland but operates in various countries with differing tax laws

and rates. Further, a portion of the Company’s income (loss) before taxes and the provision for (benefit

from) income taxes is generated outside of Switzerland.

Income (loss) before income taxes for the fiscal years 2015, 2014 and 2013 is summarized as

follows (in thousands):

Years Ended March 31,

2015 2014 2013

Swiss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $112,308 $49,503 $ (53,004)

Non-Swiss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (98,535) 28,079 (200,324)

Income (loss) before taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 13,773 $77,582 $(253,328)

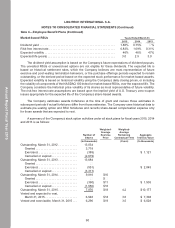

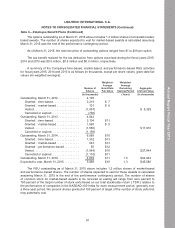

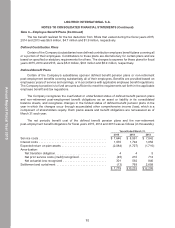

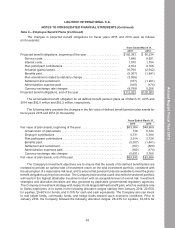

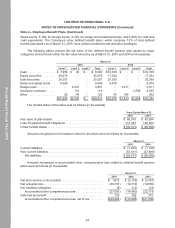

Note 4—Employee Benefit Plans (Continued)

96

Annual Report Fiscal Year 2015