Logitech 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

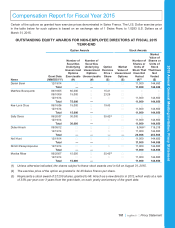

Compensation Report for Fiscal Year 2015

97 | – Proxy Statement

2015 Annual General Meeting Invitation, Proxy Statement

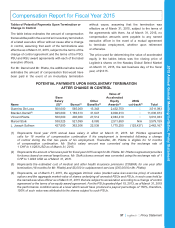

Tables of Potential Payments Upon Termination or

Change in Control

The table below estimates the amount of compensation

that would be paid in the event of an involuntary termination

of a listed executive officer without cause after a change

in control, assuming that each of the terminations was

effective as of March 31, 2015, subject to the terms of the

change of control agreement and the terms of the PSO,

PSU and RSU award agreements with each of the listed

executive officers.

For Mr. Darrell and Mr. Pilette, the additional table below

estimates the amount of compensation that would have

been paid in the event of an involuntary termination

without cause, assuming that the termination was

effective as of March 31, 2015, subject to the terms of

the agreements with them. As of March 31, 2015, no

compensation amounts were payable to any named

executive officer in the event of a mutual agreement

to terminate employment, whether upon retirement

or otherwise.

The price used for determining the value of accelerated

equity in the tables below was the closing price of

Logitech’s shares on the Nasdaq Global Select Market

on March 31, 2015, the last business day of the fiscal

year, of $13.15.

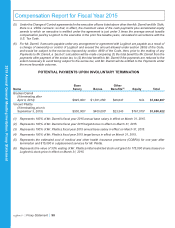

POTENTIAL PAYMENTS UPON INVOLUNTARY TERMINATION

AFTER CHANGE IN CONTROL

Name

Base

Salary

($)(1) Bonus(2)

Other

Benefits(3)

Value of

Accelerated

Equity

Awards(4)

280G

cut-back(5) Total

Guerrino De Luca 500,000 565,000 13,343 2,432,750 — 3,511,093

Bracken Darrell(6) 825,000 1,165,313 31,647 9,008,913 — 11,030,873

Vincent Pilette 500,000 400,000 27,514 2,983,419 — 3,910,933

Marcel Stolk 538,325 521,099 8,085 2,511,650 N/A 3,579,159

L. Joseph Sullivan 427,500 362,306 22,538 1,775,250 (125,427) 2,462,167

(1) Represents fiscal year 2015 annual base salary in effect on March 31, 2015. Mr. Pilette’s agreement

calls for 18 months of compensation continuation if his employment is terminated following a change

of control during the first two years of his employment. Thereafter, Mr. Pilette is eligible for 12 months

of compensation continuation. Mr. Stolk’s salary amount was converted using the exchange rate of

1 CHF to 1.0283 USD as of March 31, 2015.

(2) Represents the amount of bonuses paid for fiscal year 2015 except for Mr. Pilette. Mr. Pilette’s agreement provides

for bonus based on annual target bonus. Mr. Stolk’s bonus amount was converted using the exchange rate of 1

CHF to 1.0283 USD as of March 31, 2015.

(3) Represents the estimated cost of medical and other health insurance premiums (COBRA) for one year after

termination (18 months for Mr. Pilette) and $5,000 in outplacement services ($15,000 for Mr. Pilette).

(4) Represents, as of March 31, 2015, the aggregate intrinsic value (market value less exercise price) of unvested

options and the aggregate market value of shares underlying all unvested RSUs and PSUs, in each case held by

the named executive officer as of March 31, 2015 that are subject to acceleration according to a change of control

agreement or the terms of an equity award agreement. For the PSUs granted April 15, 2013, as of March 31, 2015

the performance condition were at a level which would have produced a payout percentage of 150%, therefore,

150% of such value was attributed to the shares subject to such PSUs.