Logitech 2015 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

out of retained earnings to Logitech shareholders who owned shares on September 16, 2013. Eligible

shareholders were paid CHF 0.21 per share ($0.22 per share in U.S. Dollars), totaling $36.1 million in

U.S. Dollars on September 17, 2013. On September 5, 2012, Logitech’s shareholders approved a cash

dividend payment of CHF 125.7 million out of retained earnings to Logitech shareholders who owned

shares on September 17, 2012. Eligible shareholders were paid CHF 0.79 per share ($0.85 per share in

U.S. Dollars), totaling $133.5 million in U.S. Dollars on September 18, 2012. The dividend in September

2012 qualified as a distribution of qualifying additional paid-in-capital and, as such, was not subject to

Swiss Federal withholding tax.

Dividends paid and similar cash or in-kind distributions made by Logitech to a holder of Logitech

shares (including dividends or liquidation proceeds and stock dividends), other than distributions of

qualifying additional paid-in-capital if it is available under the current Swiss tax regime, are subject to a

Swiss federal anticipatory tax at a rate of 35%. The anticipatory tax must be withheld by Logitech from

the gross distribution, and paid to the Swiss Federal Tax Administration.

A Swiss resident holder and beneficial owner of Logitech shares may qualify for a full refund of the

Swiss anticipatory tax withheld from such dividends. A holder and beneficial owner of Logitech shares

who is a non-resident of Switzerland, but a resident of a country that maintains a double tax treaty with

Switzerland, may qualify for a full or partial refund of the Swiss anticipatory tax withheld from such

dividends by virtue of the provisions of the applicable treaty between Switzerland and the country of

residence of the holder and beneficial owner of the Logitech shares.

In accordance with the tax convention between the United States and the Swiss Confederation

(“Treaty”), a mechanism is provided whereby a U.S. resident (as determined under the Treaty), and

U.S. corporations, other than U.S. corporations having a “permanent establishment” or a fixed base, as

defined in the Treaty, in Switzerland, generally can obtain a refund of the Swiss anticipatory tax withheld

from dividends in respect of Logitech shares, to the extent that 15% of the gross dividend is withheld as

final withholding tax (i.e. 20% of the gross dividend may generally be refunded). In specific cases, U.S.

companies not having a “permanent establishment” or a fixed base in Switzerland owning at least 10%

of Logitech registered shares may receive a refund of the Swiss anticipatory tax withheld from dividends

to the extent it exceeds 5% of the gross dividend (i.e., 30% of the gross dividend may be refunded). To

get the benefit of a refund, holders must beneficially own Logitech shares at the time such dividend

becomes due.

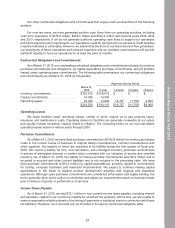

Share Repurchases

The following table presents certain information related to purchases made by Logitech of its equity

securities under its publicly announced share buyback program (in thousands, except per share amounts):

Shares

Repurchased

Weighted

Average Price

Per Share Amount

Available for

RepurchaseDuring Fiscal Year Ended CHF USD

March 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,600 9.66 10.21 $ 6,472

March 31, 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — — 250,000

March 31, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 115 — 14.43 248,337

8,715

36

Annual Report Fiscal Year 2015