Logitech 2015 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our other contractual obligations and commitments that require cash are described in the following

sections.

For over ten years, we have generated positive cash flows from our operating activities, including

cash from operations of $178.6 million, $205.4 million and $122.4 million during fiscal years 2015, 2014

and 2013, respectively. If we do not generate sufficient operating cash flows to support our operations

and future planned cash requirements, our operations could be harmed and our access to credit facilities

could be restricted or eliminated. However, we believe that the trend of our historical cash flow generation,

our projections of future operations and reduced expenses and our available cash balances will provide

sufficient liquidity to fund our operations for at least the next 12 months.

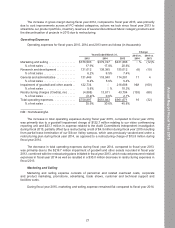

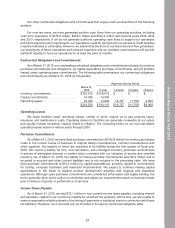

Contractual Obligations and Commitments

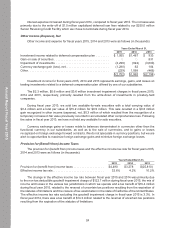

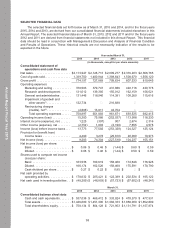

As of March 31, 2015, our outstanding contractual obligations and commitments included: (i) inventory

purchase commitments and obligations, (ii) capital expenditure purchase commitments, and (iii) facilities

leased under operating lease commitments. The following table summarizes our contractual obligations

and commitments as of March 31, 2015 (in thousands):

Payments Due by Period

March 31,

2015 <1 year 1-3 years 4-5 years >5 years

Inventory commitments . . . . . . . . . . . . . . . . $165,912 $165,912 $ — $ — $ —

Capital commitments . . . . . . . . . . . . . . . . . . 14,390 14,390 — — —

Operating leases . . . . . . . . . . . . . . . . . . . . . 54,232 13,829 18,727 11,768 9,908

$234,534 $194,131 $18,727 $11,768 $9,908

Operating Leases

We lease facilities under operating leases, certain of which require us to pay property taxes,

insurance and maintenance costs. Operating leases for facilities are generally renewable at our option

and usually include escalation clauses linked to inflation. The remaining terms on our non-cancelable

operating leases expire in various years through 2030.

Purchase Commitments

As of March 31, 2015, we have fixed purchase commitments of $165.9 million for inventory purchases

made in the normal course of business to original design manufacturers, contract manufacturers and

other suppliers, the majority of which are expected to be fulfilled during the first quarter of fiscal year

2016. We record a liability for firm, non-cancelable, and unhedged inventory purchase commitments

in excess of anticipated demand or market value consistent with our valuation of excess and obsolete

inventory. As of March 31, 2015, the liability for these purchase commitments was $9.8 million and is

recorded in accrued and other current liabilities and is not included in the preceding table. We have

fixed purchase commitments of $14.4 million for capital expenditures, primarily related to commitments

for tooling, computer hardware and leasehold improvements. We expect to continue making capital

expenditures in the future to support product development activities and ongoing and expanded

operations. Although open purchase commitments are considered enforceable and legally binding, the

terms generally allow us the option to reschedule and adjust our requirements based on business needs

prior to delivery of goods or performance of services.

Income Taxes Payable

As of March 31, 2015, we had $72.1 million in non-current income taxes payable, including interest

and penalties, related to our income tax liability for uncertain tax positions. At this time, we are unable to

make a reasonably reliable estimate of the timing of payments in individual years in connection with these

tax liabilities; therefore, such amounts are not included in the above contractual obligation table.

29

Annual Report Fiscal Year 2015