Logitech 2015 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

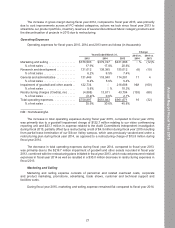

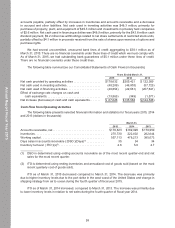

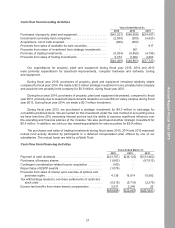

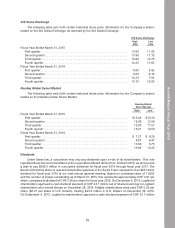

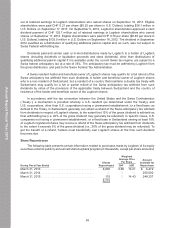

Cash Flow from Investing Activities

Years Ended March 31,

2015 2014 2013

Purchases of property, plant and equipment. . . . . . . . . . . . . . . . . . . $(45,253) $(46,658) $(54,487)

Investment in privately held companies . . . . . . . . . . . . . . . . . . . . . . (2,550) (300) (4,420)

Acquisitions, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . (926) (650) —

Proceeds from sales of available-for-sale securities . . . . . . . . . . . . . — — 917

Proceeds from return of investment from strategic investments . . . . — 261 —

Purchase of trading investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,034) (8,450) (4,196)

Proceeds from sales of trading investments . . . . . . . . . . . . . . . . . . . 5,474 8,994 4,463

$(48,289) $(46,803) $(57,723)

Our expenditures for property, plant and equipment during fiscal year 2015, 2014 and 2013

were primarily expenditures for leasehold improvements, computer hardware and software, tooling

and equipment.

During fiscal year 2015, purchases of property, plant and equipment remained relatively stable

compared to fiscal year 2014. We made a $2.5 million strategic investment in one privately held company

and acquired one privately held company for $0.9 million, during fiscal year 2015.

During fiscal year 2014, purchases of property, plant and equipment decreased, compared to fiscal

year 2013, primarily due to leasehold improvements related to our new Silicon Valley campus during fiscal

year 2013. During fiscal year 2014, we made a $0.7 million investment.

During fiscal year 2013, we purchased a strategic investment for $4.0 million in exchange for

convertible preferred stock. We accounted for this investment under the cost method of accounting since

we have less than 20% ownership interest and we lack the ability to exercise significant influence over

the operating and financial policies of the investee. We also purchased another strategic investment for

$0.4 million. In addition, we sold our two remaining available-for-sale securities for $0.9 million.

The purchases and sales of trading investments during fiscal years 2015, 2014 and 2013 represent

mutual fund activity directed by participants in a deferred compensation plan offered by one of our

subsidiaries. The mutual funds are held by a Rabbi Trust.

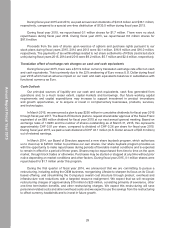

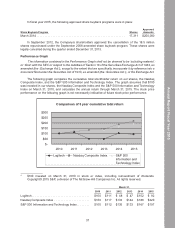

Cash Flow from Financing Activities

Years Ended March 31,

2015 2014 2013

Payment of cash dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(43,767) $(36,123) $(133,462)

Purchases of treasury shares . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,663) — (87,812)

Contingent consideration related to prior acquisition . . . . . . . . . (100) — —

Repurchase of ESPP awards . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,078) — —

Proceeds from sales of shares upon exercise of options and

purchase rights . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,138 16,914 15,982

Tax withholdings related to net share settlements of restricted

stock units . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9,215) (5,718) (2,375)

Excess tax benefits from share-based compensation . . . . . . . . 2,831 2,246 26

$(48,854) $(22,681) $(207,641)

27

Annual Report Fiscal Year 2015