Logitech 2015 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

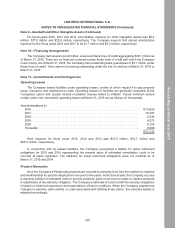

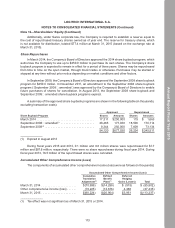

Note 9—Goodwill and Other Intangible Assets (Continued)

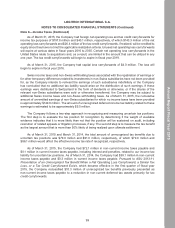

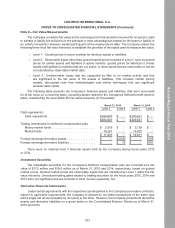

In reviewing goodwill for impairment, an entity has the option to first assess qualitative factors to

determine whether the existence of events or circumstances leads to a determination that it is more

likely than not (greater than 50%) that the estimated fair value of a reporting unit is less than its carrying

amount. If an entity elects to perform a qualitative assessment and determines that an impairment is more

likely than not, the entity is then required to perform the two-step quantitative impairment test; otherwise,

no further analysis is required. An entity also may elect not to perform the qualitative assessment and,

instead, proceed directly to the two-step quantitative impairment test. The ultimate outcome of the

goodwill impairment review for a reporting unit should be the same whether an entity chooses to perform

the qualitative assessment or proceeds directly to the two-step quantitative impairment test. Goodwill is

allocated among and evaluated for impairment at the reporting unit level, which is defined as an operating

segment or one level below an operating segment. The Company has two reporting units, peripherals

and video conferencing.

Peripherals

The Company performed its annual impairment analysis of the goodwill for its peripherals reporting

unit at December 31, 2014 by performing a qualitative assessment and concluded that it was more likely

than not that the fair value of its peripherals reporting unit exceeded its carrying amount. In assessing

the qualitative factors, the Company considered the impact of these key factors: change in industry and

competitive environment, growth in market capitalization of $2.3 billion as of December 31, 2014 from

$2.2 billion a year ago, and budgeted-to-actual revenue performance from the prior year. The peripherals

reporting unit has seen an improvement in operating income from $64.8 million and $117.8 million for the

three and nine months ended December 31, 2013 to $76.1 million and $160.3 million for the three and nine

months ended December 31, 2014, respectively. No recent events or changes in circumstances indicate

that impairment existed as of March 31, 2015.

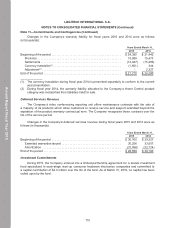

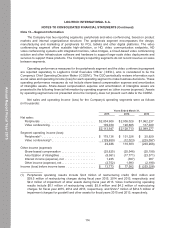

Video Conferencing

The Company proceeded directly to the two-step quantitative impairment test for the video

conferencing reporting unit and performed a Step 1 assessment at December 31, 2014. The Company

uses a third party valuation expert in the development of its market and income approach models. The

annual Step 1 assessment performed as of December 31, 2014 resulted in the Company determining that

the video conferencing reporting unit passed the Step 1 test because the estimated fair value of the video

conferencing reporting unit from the Step 1 assessment exceeded its carrying value by approximately

38.0%, thus not requiring a Step 2 assessment of this reporting unit. Therefore, the Company concluded

it was more likely than not that the goodwill of the video conferencing reporting unit was not impaired as

of December 31, 2014.

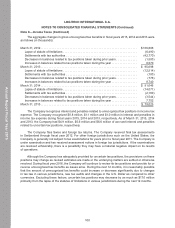

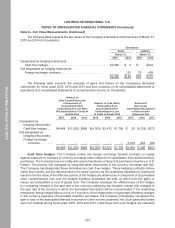

During the fourth quarter of the fiscal year ended March 31, 2015, the net sales of the video

conferencing reporting unit decreased to $24.9 million from $31.0 million in the fourth quarter of the fiscal

year ended March 31, 2014 and from $29.9 million in the third quarter of fiscal year ended March 31, 2015.

The sales decline was concentrated in the video conferencing infrastructure legacy business primarily

due to faster shift of customer preference towards Cloud infrastructure conferencing versus on-premise

infrastructure solutions and resource realignment, which was not anticipated during annual impairment

assessment as of December 31, 2014. This quick shift towards Cloud-based offering resulted in the change

in business strategy to de-emphasize Lifesize’s legacy offerings more quickly than planned to enable

maximum traction of the Lifesize Cloud, which would result in shrinking the legacy Lifesize business but

could grow the Cloud opportunity faster. In the last nine months, the sales of Cloud-based offerings have

106

Annual Report Fiscal Year 2015