Logitech 2015 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

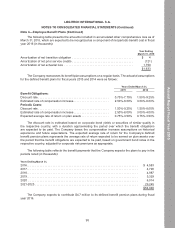

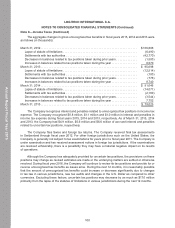

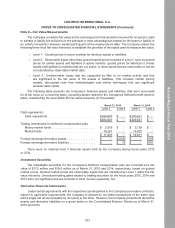

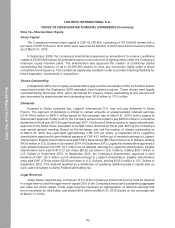

Note 8—Fair Value Measurements (Continued)

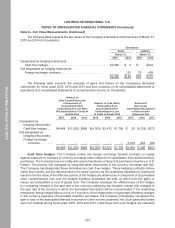

as operating activities in the Consolidated Statements of Cash Flows. As of March 31, 2015, and 2014,

the notional amounts of foreign exchange forward contracts outstanding related to forecasted inventory

purchases were $43.5 million and $51.8 million, respectively. The Company estimates that $4.0 million of

net gains related to its cash flow hedges included in accumulated other comprehensive loss as of

March 31, 2015 will be reclassified into earnings within the next 12 months.

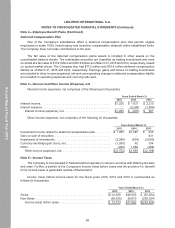

Other Derivatives: The Company also enters into foreign exchange forward and swap contracts to

reduce the short-term effects of currency fluctuations on certain foreign currency receivables or payables.

These forward and swap contracts generally mature within one month. The primary risk managed by

using forward and swap contracts is the currency exchange rate risk. The gains or losses on foreign

exchange forward contracts are recognized in other income (expense), net based on the changes in

fair value.

The notional amounts of foreign exchange forward and swap contracts outstanding as of March 31,

2015 and 2014 relating to foreign currency receivables or payables were $61.7 million and $53.7 million,

respectively. Open forward and swap contracts as of March 31, 2015 and 2014 consisted of contracts in

Taiwanese Dollars, Australian Dollars, Mexican Pesos, Japanese Yen and British Pounds to be settled at

future dates at pre-determined exchange rates.

The fair value of all foreign exchange forward and swap contracts is determined based on observable

market transactions of spot currency rates and forward rates. Cash flows from these contracts are

classified as operating activities in the Consolidated Statements of Cash Flows.

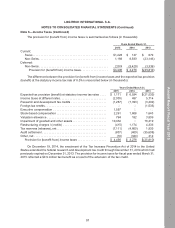

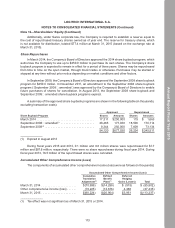

Non-Financial Assets Measured at Fair Value on a Nonrecurring Basis

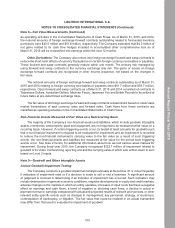

The majority of the Company’s non-financial assets and liabilities, which include goodwill, intangible

assets, inventories, and property, plant and equipment, are not required to be measured at fair value on a

recurring basis. However, if certain triggering events occur (or tested at least annually for goodwill) such

that a non-financial instrument is required to be evaluated for impairment and an impairment is recorded

to reduce the non-financial instrument’s carrying value to the fair value as a result of such triggering

events, the non-financial assets and liabilities are measured at fair value for the period such triggering

events occur. See Note 2 herein, for additional information about how we test various asset classes for

impairment. During fiscal year 2015, the Company recognized $122.7 million of impairment related to

goodwill of its Video Conferencing reporting unit and the carrying value of which was written down to zero

based on Level 3 inputs.

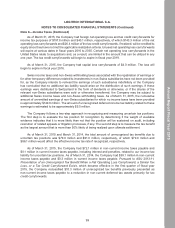

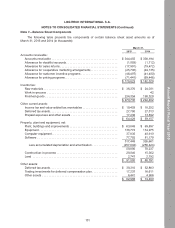

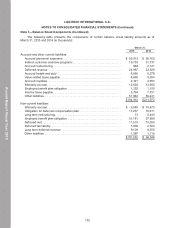

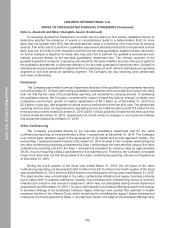

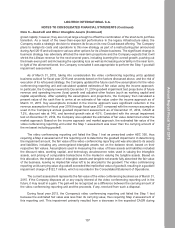

Note 9—Goodwill and Other Intangible Assets

Annual Goodwill Impairment Testing

The Company conducts a goodwill impairment analysis annually at December 31 or more frequently

if indicators of impairment exist or if a decision is made to sell or exit a business. A significant amount

of judgment is involved in determining if an indicator of impairment has occurred. Such indicators may

include deterioration in general economic conditions, negative developments in equity and credit markets,

adverse changes in the markets in which an entity operates, increases in input costs that have a negative

effect on earnings and cash flows, a trend of negative or declining cash flows, a decline in actual or

planned revenue or earnings compared with actual and projected results of relevant prior periods, or other

relevant entity-specific events such as changes in management, key personnel, strategy, or customers,

contemplation of bankruptcy, or litigation. The fair value that could be realized in an actual transaction

may differ from that used to evaluate the impairment of goodwill.

105

Annual Report Fiscal Year 2015