Logitech 2015 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

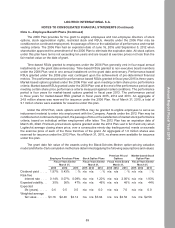

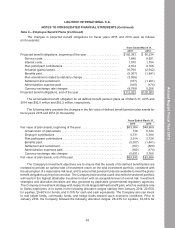

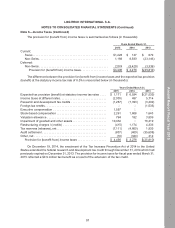

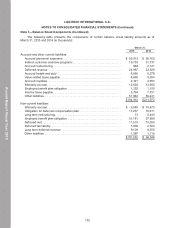

Deferred income tax assets and liabilities consist of the following (in thousands):

March 31,

2015 2014

Deferred tax assets:

Net operating loss carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,372 $ 9,421

Tax credit carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,739 13,241

Accruals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44,363 48,153

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,396 4,781

Share-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,183 15,304

Gross deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74,053 90,900

Valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,590) (4,872)

Gross deferred tax assets after valuation allowance. . . . . . . . . . . . . . . . . 68,463 86,028

Deferred tax liabilities:

Acquired intangible assets and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,299) (8,436)

Gross deferred tax liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,299) (8,436)

Deferred tax assets, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $65,164 $77,592

Management regularly assesses the ability to realize deferred tax assets recorded in the Company’s

entities based upon the weight of available evidence, including such factors as recent earnings history

and expected future taxable income. In the event that the Company changes its determination as to the

amount of deferred tax assets that can be realized, the Company will adjust its valuation allowance with a

corresponding impact to the provision for income taxes in the period in which such determination is made.

The Company had a valuation allowance of $5.6 million at March 31, 2015, increased from

$4.9 million at March 31, 2014 primarily due to $1.0 million increase in valuation allowance for deferred

tax assets in the state of California of the United States. The Company had a valuation allowance of

$3.6 million as of March 31, 2015 against such deferred tax assets. The remaining valuation allowance

primarily represents $1.5 million for capital loss carryforwards in the United States and $0.5 million for

various tax credit carryforwards. The Company determined that it is more likely than not that the Company

would not generate sufficient taxable income in the future to utilize such deferred tax assets.

Deferred tax assets relating to tax benefits of employee stock grants have been reduced to reflect

settlement activity in fiscal years 2015 and 2014. Settlement activity of grants in fiscal years 2015 and

2014 resulted in a “shortfall” in which tax deductions were less than previously recorded share-based

compensation expense. The Company recorded a shortfall to equity of $1.8 million and $2.8 million,

respectively, in fiscal years 2015 and 2014.

Note 6—Income Taxes (Continued)

98

Annual Report Fiscal Year 2015