Logitech 2015 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

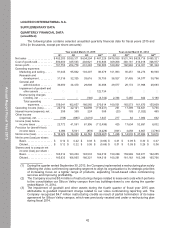

LOGITECH INTERNATIONAL S.A.

SUPPLEMENTARY DATA

QUARTERLY FINANCIAL DATA

(unaudited)

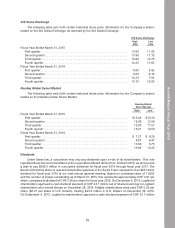

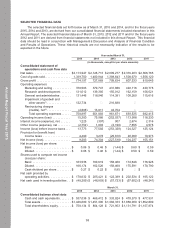

The following table contains selected unaudited quarterly financial data for fiscal years 2015 and

2014 (in thousands, except per share amounts):

Year ended March 31, 2015 Year ended March 31, 2014

Q1 Q2 Q3 Q4(3) Q1 Q2(1) Q3 Q4(2)

Net sales . . . . . . . . . . . . . . . . . $482,203 $ 530,311 $ 634,204 $ 467,229 $ 478,530 $ 531,143 $628,719 $ 490,321

Cost of goods sold . . . . . . . . . . 300,450 325,533 402,921 310,846 309,268 348,181 414,418 328,977

Gross profit. . . . . . . . . . . . . . . . 181,753 204,778 231,283 156,383 169,262 182,962 214,301 161,344

Operating expenses:

Marketing and selling . . . . . 91,045 95,862 103,307 88,379 101,093 93,451 94,273 90,930

Research and

development . . . . . . . . . 31,316 32,325 33,616 33,755 36,527 37,485 34,577 30,796

General and

administrative . . . . . . . . 36,680 34,470 29,808 30,488 29,077 29,172 31,998 28,693

Impairment of goodwill and

other assets . . . . . . . . . — — — 122,734 — — — —

Restructuring charges

(credits), net . . . . . . . . . — — (146) (4,742) 2,334 5,465 822 5,190

Total operating

expenses. . . . . . . . . 159,041 162,657 166,585 270,614 169,031 165,573 161,670 155,609

Operating income (loss). . . . . . 22,712 42,121 64,698 (114,231) 231 17,389 52,631 5,735

Interest income (expense), net. . 258 355 224 388 (23) 183 (1,022) 465

Other income

(expense), net. . . . . . . . . . . (198) (885) (3,016) 1,347 217 62 1,082 632

Income (loss) before

income taxes . . . . . . . . . . . 22,772 41,591 61,906 (112,496) 425 17,634 52,691 6,832

Provision for (benefit from)

income taxes . . . . . . . . . . . 3,096 5,501 (878) (3,229) (801) 3,058 4,807 (3,786)

Net income (loss) . . . . . . . . . . . $ 19,676 $ 36,090 $ 62,784 $(109,267) $ 1,226 $ 14,576 $ 47,884 $ 10,618

Net income (loss) per share:

Basic. . . . . . . . . . . . . . . . . . $ 0.12 $ 0.22 $ 0.38 $ (0.66) $ 0.01 $ 0.09 $ 0.30 $ 0.07

Diluted. . . . . . . . . . . . . . . . . $ 0.12 $ 0.22 $ 0.38 $ (0.66) $ 0.01 $ 0.09 $ 0.29 $ 0.06

Shares used to compute net

income (loss) per share :

Basic. . . . . . . . . . . . . . . . . . 163,012 163,230 163,533 164,319 159,298 159,969 160,871 162,255

Diluted. . . . . . . . . . . . . . . . . 165,833 166,065 166,321 164,319 160,281 161,183 163,388 165,766

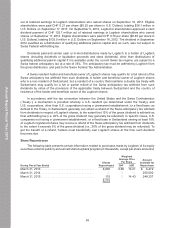

(1) During the quarter ended September 30, 2013, the Company implemented a restructuring plan solely

affecting the video conferencing operating segment to align its organization to its strategic priorities

of increasing focus on a tighter range of products, expanding Cloud-based video conferencing

services and improving profitability.

(2) The Company incurred $5.4 million of restructuring charges related to lease exit costs which pertains

to the consolidation our Silicon Valley campus from two buildings down to one during the quarter

ended March 31, 2014.

(3) The impairment of goodwill and other assets during the fourth quarter of fiscal year 2015 was

attributable to goodwill impairment charge related to our video conferencing reporting unit. The

Company recognized $4.7 million restructuring credits as result of partial termination of its lease

agreement for Silicon Valley campus, which was previously vacated and under a restructuring plan

during fiscal 2014.

42

Annual Report Fiscal Year 2015