Logitech 2015 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

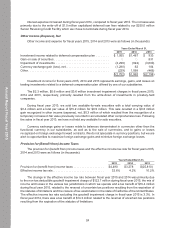

The change in the effective income tax rate between fiscal year 2014 and 2013 was primarily due to

the mix of income and losses in the various tax jurisdictions and a tax benefit of $14.3 million during fiscal

year 2014, related to the reversal of uncertain tax positions resulting from the expiration of the statutes of

limitations. In fiscal year 2013, there was a tax benefit of $35.6 million related to the reversal of uncertain

tax positions resulting from the closure of federal income tax examinations in the United States.

On December 19, 2014, the enactment of the Tax Increase Prevention Act of 2014 in the United

States extended the federal research and development tax credit through December 31, 2014 which had

previously expired on December 31, 2013. The provision for income taxes for fiscal year ended March 31,

2015 reflected a $0.9 million tax benefit as a result of the extension of the tax credit.

As of March 31, 2015 and March 31, 2014, the total amount of unrecognized tax benefits due to

uncertain tax positions was $79.0 million and $91.0 million, respectively, of which $79.0 million and

$86.1 million would affect the effective income tax rate if recognized, respectively.

As of March 31, 2015, we had $72.1 million in non-current income taxes payable and $0.1 million

in current income taxes payable, including interest and penalties, related to our income tax liability

for uncertain tax positions. As of March 31, 2014, we had $93.1 million in non-current income taxes

payable and $0.3 million in current income taxes payable. Pursuant to ASU 2013-11, Presentation of

an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax

Credit Carryforward Exists, which became effective in the first quarter of fiscal year 2015, we reclassified

$10.3 million of unrecognized tax benefits previously presented as non-current income taxes payable to

a reduction in non-current deferred tax assets primarily for tax credit carryforwards.

We continue to recognize interest and penalties related to unrecognized tax positions in income tax

expense. We recognized $0.8 million, $1.1 million and $1.0 million in interest and penalties in income tax

expense during fiscal years 2015, 2014 and 2013, respectively. As of March 31, 2015, 2014 and 2013, we

had approximately $4.9 million, $5.6 million and $6.6 million of accrued interest and penalties related to

uncertain tax positions.

We file Swiss and foreign tax returns. We received final tax assessments in Switzerland through

fiscal year 2012. For other foreign jurisdictions such as the United States, we are generally not subject

to tax examinations for years prior to fiscal year 2011. We are under examination and have received

assessment notices in foreign tax jurisdictions. If the examinations are resolved unfavorably, there is a

possibility they may have a material negative impact on our results of operations.

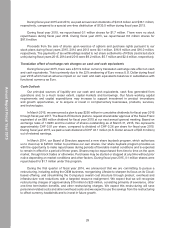

Liquidity and Capital Resources

Cash Balances, Available Borrowings, and Capital Resources

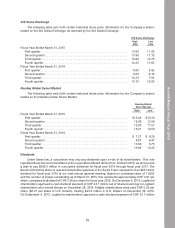

At March 31, 2015, we had cash and cash equivalents of $537.0 million, compared with $469.4 million

at March 31, 2014. Our cash and cash equivalents consist of bank demand deposits and short-term time

deposits of which 81% is held by our Swiss-based entities and 11% is held by our subsidiaries in Hong

Kong and China. We do not expect to incur any material adverse tax impact or be significantly inhibited

by any country in which we do business from the repatriation of funds to Switzerland, our home domicile.

At March 31, 2015, our working capital was $557.1 million compared with working capital of

$478.2 million at March 31, 2014. The increase in working capital over the prior year was primarily due to

higher cash and inventory balances, partially offset by higher accounts payable balances at March 31, 2015.

During fiscal year 2015, we generated $178.6 million cash from operating activities. Our main sources

of operating cash flows were from net income after adding back non-cash expenses of depreciation,

amortization, impairment of goodwill and share-based compensation expense, and from an increase in

25

Annual Report Fiscal Year 2015