Logitech 2015 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2015 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

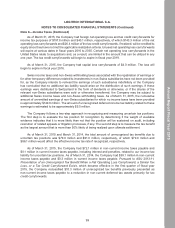

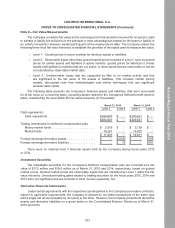

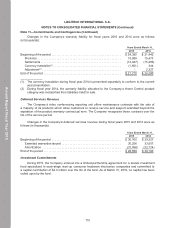

Note 8—Fair Value Measurements

The Company considers fair value as the exchange price that would be received for an asset or paid

to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in

an orderly transaction between market participants at the measurement date. The Company utilizes the

following three-level fair value hierarchy to establish the priorities of the inputs used to measure fair value:

• Level 1—Quoted prices in active markets for identical assets or liabilities.

• Level 2—Observable inputs other than quoted market prices included in Level 1, such as quoted

prices for similar assets and liabilities in active markets; quoted prices for identical or similar

assets and liabilities in markets that are not active; or other inputs that are observable or can be

corroborated by observable market data.

• Level 3—Unobservable inputs that are supported by little or no market activity and that

are significant to the fair value of the assets or liabilities. This includes certain pricing

models, discounted cash flow methodologies and similar techniques that use significant

unobservable inputs.

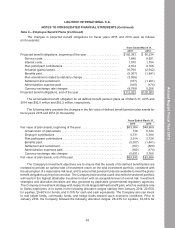

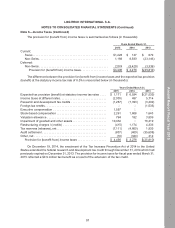

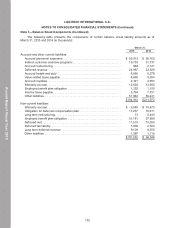

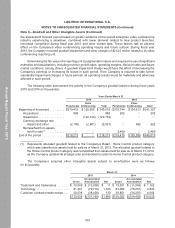

The following table presents the Company’s financial assets and liabilities, that were accounted

for at fair value on a recurring basis, excluding assets related to the Company’s defined benefit pension

plans, classified by the level within the fair value hierarchy (in thousands):

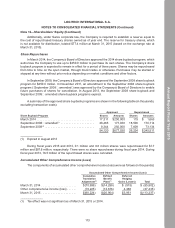

March 31, 2015 March 31, 2014

Level 1 Level 2 Level 1 Level 2

Cash equivalents:

Cash equivalents. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $264,647 $ — $200,641 $ —

$264,647 $ — $200,641 $ —

Trading investments for deferred compensation plan:

Money market funds . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,936 $ — $ 3,139 $ —

Mutual funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,301 — 13,472 —

$ 17,237 $ — $ 16,611 $ —

Foreign exchange derivative assets. . . . . . . . . . . . . . . . . . $ — $2,080 $ — $155

Foreign exchange derivative liabilities . . . . . . . . . . . . . . . . $ — $ 75 $ — $701

There were no material level 3 financial assets held by the Company during fiscal years 2015

or 2014.

Investment Securities

The marketable securities for the Company’s deferred compensation plan are recorded at a fair

value of $17.2 million and $16.6 million as of March 31, 2015 and 2014, respectively, based on quoted

market prices. Quoted market prices are observable inputs that are classified as Level 1 within the fair

value hierarchy. Unrealized trading gains related to trading securities for the fiscal years 2015, 2014 and

2013 were not significant and are included in other income (expense), net.

Derivative Financial Instruments

Under certain agreements with the respective counterparties to the Company’s derivative contracts,

subject to applicable requirements, the Company is allowed to net settle transactions of the same type

with a single net amount payable by one party to the other. However, the Company presents its derivative

assets and derivative liabilities on a gross basis on the Consolidated Balance Sheets as of March 31,

2015 and 2014.

103

Annual Report Fiscal Year 2015