Foot Locker 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

common stock at 85 percent of the lower market price on one of two specified dates in each plan year. Under the 2003

Employee Stock Purchase Plan, 3,000,000 shares of common stock are authorized for purchase beginning June 2005. Of

the 3,000,000 shares of common stock authorized for purchase under this plan, 806 participating employees purchased

105,123 shares in 2006 and 1,191 participating employees purchased 237,353 shares in 2005.

Valuation Model and Assumptions

The Company uses a Black-Scholes option-pricing model to estimate the fair value of share-based awards under

SFAS No. 123(R), which is the same valuation technique it previously used for pro forma disclosures under SFAS No.

123. The Black-Scholes option-pricing model incorporates various and highly subjective assumptions, including

expected term and expected volatility.

The Company estimates the expected term of share-based awards granted using the Company’s historical exercise

and post-vesting employment termination patterns, which it believes are representative of future behavior. The

expected term for the Company’s employee stock purchase plan valuation is based on the length of each purchase

period as measured at the beginning of the offering period, which is one year. The Company estimates the expected

volatility of its common stock at the grant date using a weighted-average of the Company’s historical volatility and

implied volatility from traded options on the Company’s common stock. The Company believes that the combination

of historical volatility and implied volatility provides a better estimate of future stock price volatility. The risk-free

interest rate assumption is determined using the Federal Reserve nominal rates for U.S. Treasury zero-coupon bonds

with maturities similar to those of the expected term of the award being valued. The expected dividend yield is derived

from the Company’s historical experience.

Additionally, SFAS No. 123(R) requires the Company to estimate pre-vesting option forfeitures at the time of

grant and periodically revise those estimates in subsequent periods if actual forfeitures differ from those estimates.

The Company records stock-based compensation expense only for those awards expected to vest using an estimated

forfeiture rate based on its historical pre-vesting forfeiture data. Previously, the Company accounted for forfeitures as

they occurred under the pro forma disclosure provisions of SFAS No. 123 for periods prior to 2006.

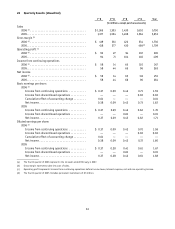

The following table shows the Company’s assumptions used to compute the stock-based compensation expense

and pro forma information:

Stock Option Plans Stock Purchase Plan

2006 2005 2004 2006 2005 2004

Weighted-average risk free rate

of interest .............. 4.68% 3.99% 2.57% 4.39% 4.19% 1.33%

Expected volatility .......... 30% 28% 33% 22% 25% 32%

Weighted-average expected

award life .............. 4.0 years 3.8 years 3.7 years 1.0 years .7 years .7 years

Dividend yield ............. 1.5% 1.1% 1.1% 1.4% — —

Weighted-average fair value . . . $6.36 $6.69 $6.51 $4.71 $5.54 $11.44